Reference no: EM131525955

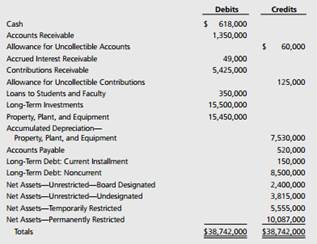

Question: Comprehensive Problem. As of July 1, 2011, the trial balance for Korner College was as follows:

During the year ended June 30, 2012, the following transactions occurred:

1. Cash collections included: accounts receivable, $1,200,000; accrued interest receivable, $49,000; contributions receivable, $5,345,000; and for loans to students and faculty, $155,000. Of the contributions, $1,900,000 was for plant acquisition (use for cash flow statement).

2. Cash payments included accounts payable, $520,000; and the current portion of long-term debt, $150,000.

3. Unrestricted revenues included tuition and fees, $21,800,000; unrestricted income on endowment investments, $400,000; other investment income, $300,000; and sales and services of auxiliary enterprises, $14,740,000. A total of $33,690,000 in cash was received, and the following receivables were increased: accounts receivable, $3,500,000; accrued interest receivable, $50,000.

4. Scholarships, for which no services were required, were applied to student accounts in the amount of $2,200,000

5. Contributions were received in the following amounts: unrestricted, $4,900,000; temporarily restricted, $5,400,000; permanently restricted, $2,000,000. Of that amount, $7,020,000 was received in cash; contributions receivable increased $5,280,000. None of these contributions were restricted to plant acquisition.

6. Accounts receivable were written off in the amount of $50,000, and contributions receivable were written off in the amount of $20,000. Provisions for bad debts were increased by $125,000 for accounts receivable (tuition and fees) and by $30,000 for unrestricted contributions receivable.

7. Expenses, exclusive of depreciation and uncollectible accounts, were as follows: instruction, $18,460,000; research, $1,980,000; public service, $1,910,000; academic support, $990,000; student services, $1,310,000; institutional support, $1,050,000; and auxiliary enterprises, $13,500,000. The college had an uninsured flood loss in the amount of $600,000. Cash was paid in the amount of $39,200,000, and accounts payable increased by $600,000.

8. Depreciation was charged in the amount of $1,500,000. One-third of that amount was charged each to instruction, institutional support, and auxiliary enterprises.

9. Interest income was earned as follows: addition to temporarily restricted net assets, $30,000; addition to permanently restricted net assets, $35,000. Of those amounts, $55,000 was received in cash and $10,000 was accrued at year-end.

10. Research expense was incurred in the amount of $1,700,000; and property, plant, and equipment were acquired in the amount of $1,400,000. Both were paid in cash.

11. Reclassifications were made from temporarily restricted to unrestricted net assets as follows: on the basis of time restrictions, $1,600,000; for program restrictions (research), $1,700,000; and for fixed asset acquisition restrictions, $1,400,000. Korner records fixed assets as increases in unrestricted net assets. 12. Long-term investments, with a carrying value of $1,700,000, were sold for $1,770,000. Of the $70,000 gain, $40,000 was temporarily restricted by donor agreement and $30,000 is required to be added to permanently restricted net assets.

13. Additional investments were purchased in the amount of $3,970,000. Loans were made to students and faculty in the amount of $200,000.

14. In addition to 13 above, the board of trustees decided to purchase $2,000,000 in long-term investments, from unrestricted net assets, to create a quasi-endowment.

15. At year-end, the fair value of investments increased by $530,000. Of that amount, $300,000 increased unrestricted net assets, $30,000 increased temporarily restricted net assets, and $200,000 increased permanently restricted net assets.

16. $150,000 of the long-term debt was reclassified as a current liability.

17. Closing entries were prepared for

( a ) unrestricted net assets,

( b ) temporarily restricted net assets, and

( c ) permanently restricted net assets.

Required: a. Prepare journal entries for each of the above transactions.

b. Prepare a Statement of Unrestricted Revenues, Expenses, and Other Changes in Unrestricted Net Assets for Korner College for the fiscal year ended June 30, 2012.

c. Prepare a Statement of Changes in Net Assets for Korner College for the fiscal year ended June 30, 2012.

d. Prepare a Statement of Financial Position for Korner College as of June 30, 2012.

e. Prepare a Statement of Cash Flows for Korner College for the year ended June 30, 2012. Use the indirect method.