Reference no: EM13903

CAPM

Stock S has a volatility �S = 14% and the covariance of its return with the return of the market portfolio is �SM = 0:0150. The risk-free rate is rf = 3% and the market portfolio has an expected return E(rM) = 7%, and a volatility �M = 12%.

1. Using the CAPM, compute the expected return, E(rpf ), and volatility, �pf , of portfolio P which has 50% invested in S and 50% invested in the risk-free asset.

2. According to the CAPM, what is the portfolio P0 that has the same expected return as P and the lowest possible volatility? Check that P0 's volatility is indeed lower than P's volatility.

3. Suppose that you invest in P0 today, sell it in one year and realize a return of 4%. Does that imply that the CAPM does not work? (7 points)

Venture Capital

Horus Inc. has just issued a patent on a new solar panel technology. The company wants to take advantage of the boom in the development of renewable energies to raise money and develop a marketable product.

The key aspects of the business plan are summarized below

- Development cost: $8 Millions (to be committed upfront).

- Estimated time to market (length of time until the product is available for sale): 3 years.

- Technological risk: the probability that Horus fails to develop a viable product is 40%.

- Current size of the solar panel market: $1.3 Billion (total sales per year).

- Projected annual growth of the solar panel market: 25%.

- Expected market share of Horus (if the product is viable): 5%.

- Valuation: companies in the same industry are on average valued 1.5 times their total sales (i.e. if a company has a $1 million turnover, its market value is $1.5 million).

Financial information:

- Shareholder Composition: Mr Sun, CEO, 700,000 shares; other key employees, 300,000 shares.

- No debt.

Horus was speci�cally created to develop this product and has no other lines of business.

1. You are a Senior Partner at the VC Fund Bcom Partners. Mr Sun approaches you on behalf of Horus and makes the following o�er: Horus will issue 90,000 new shares that Bcom Partners will subscribe in exchange for a $8 Millions cash injection. Given the characteristics of Solar, you think that Bcom needs an expected return of at least 10%. Will you accept Mr Sun's o�er? (10 points)

2. You are Mr Sun, and you have on your desk a term sheet (contract) proposition from the VC fund MBA Partners, who agrees to provide $8 Millions in exchange for 100,000 new shares. You are also considering an alternative o�er from Energy Venture. Energy Venture is a VC fund dedicated to investments into the energy industry. On top of a $8 millions investment, Energy Venture o�ers its expertise and networks to fasten the commercial development of Horus. The estimated impact on sales would be +10%. This added value translates however into a higher cost of �nancing: Energy Venture wants 150,000 new shares. Which o�er do you choose?

3 IPOs

Horus has developped successfully and needs additional funding. An IPO seems to be a natural step forward.

After successive �nancing rounds, Horus has 1.7 million shares outstanding. 400,000 of them are held by the VC Fund Greentech.

Greentech's fund is close to the end of its life would like to cash out. Horus goes public under �rm commitment underwriting. At the end of the book building phase, Horus shareholders and the underwriter agree on an issue of 500,000 primary shares at a price of $60 per share. Existing shareholders may also sell their own shares in the IPO.

At an issue price of $60, Greentech's managers think that the stock is undervalued by 20% (i.e. post IPO, the price will adjust to 60 � (1 + 20%) = $72).

To mitigate the underpricing problem, Greentech decides to sell only part of its stocks in the IPO, and sell the rest of its stake once the price has adjusted. What is the maximal number of shares Greentech can sell in the IPO if it wants to limit its expected loss to 10% of the market value of its stake?

4 SEOs

Horus is now public and considers raising money through a SEO. It decides to proceed with rights o�ering. There are 3.5 millions shares outstanding at that time. You have the following information on the rights issue:

- Number of rights needed to buy one share: 4.

- Total amount of money to be raised in the SEO: $10.5 millions

- Cum-rights price: $17

Just after the ex-right date, you observe that rights trade at $0.8. What do you think about this price? Is there a way you can make an immediate pro�t?

5 Debt

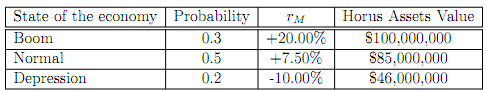

Horus is now a mature �rm and wants to issue debt for the �rst time. It needs to raise $50 million and decides to issue 50,000 bonds with maturity 1 year, face value $1,000 and coupon c. The table below provides information on the return of the market portfolio, rM, and the value of Horus' assets in one year depending on the state of the economy.

In case of bankruptcy, that is, if the value of Horus' assets in one year is too low to cover payments to bondholders (principal + interests), Horus' assets can be liquidated at their market value. The risk-free rate is 3%.

Compute the value of the coupon, c, such that bonds can be issued at par value (i.e., investors are willing to pay $1,000 per newly issued bond).