Reference no: EM131765065

Question: It is now one year since you took over Honest Albert's business. During the year you undertook enough work to generate $55,000 worth of income and spent $7,000 on items directly related to those jobs (travel, consumables, etc.). To date, you have paid $8,000 worth of invoices for overheads (electricity, paper, marketing, etc.) and you still have $2,500 worth of invoices to pay. The bank has auto-debited the full amount of interest from your account. All of your clients, except for two, have paid in full for the work done. You have sent invoices worth a total of $3,000 to the clients who have not yet paid (you can assume that they will pay soon).

The tangible assets had ten years of useful life remaining when you purchased them, after which they will have no value. The goodwill of Albert's business is deemed to be good for eight years only (for the purpose of this question, assume that you can amortise goodwill). You decide to adopt the principle of accruals for your accounting system and straight line depreciation & amortisation of your fixed assets.

(a) Construct a basic Profit & Loss Statement for the first year of activity of your new business. Show the gross profit, operating profit and profit before tax (for the purpose of this question we will disregard tax and dividends).

(b) Assume that the bank account has been used for all cash transactions related to the business. Based on the given information, calculate what should be the exact balance of your operating bank account after the first year of business activity.

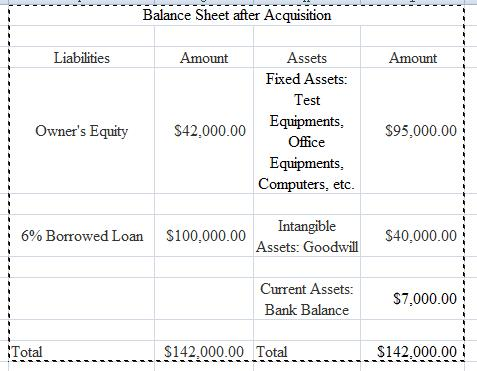

(c) Construct a new Balance Sheet representing the assets, liabilities and owner's equity at the end of the first year of activity of your new business. Verify that the new balance sheet does indeed "balance".

Balance Sheet after Acquisition Liabilities Amount Assets Amount Fixed Assets: Test Equipments Owner's Equity $42,000.00 Office S95,000.00 Equipments Computers, etc Intangible 0.000.00 6% Borrowed Loan $100,000.00 Assets: Goodwill Current Assets: Bank Balance S7,000.00 Total, 42.000.00 Total S142,000.00