Q. Evaluate Net realisable value of assets?

Valuation

(i) Method 1 - Net assets according to the statement of financial position

Value = $295000

Reservation

NBV doesn't give a fair reflection of asset values.

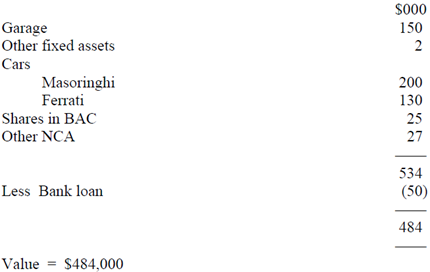

(ii) Method 2 - Net realisable value of assets

Reservations

- Improbable to sell the Masoringhi for $200000 - mayn't even be able to recover the cost of $120000. Thus the valuation is likely to be too high.

- Must the value of current assets (e.g. receivables) be written down?

(iii) Method 3 - MV = P/E ratio × Future sustainable earnings

- First a appropriate P/E ratio must be found. The major problem here is that none of the companies mentioned has the same kind of trade as the target. In particular not any deals with second-hand Italian sports cars. The ratio for Volvo must definitely be excluded - Nick doesn't make cars. A weighted average for the rest makes nous as this will incorporate selling cars and providing garage services.

P/E ratio = (136 x 13 332 x 17 287 x 16)/( 136 332 287) = 15.9

It is common to discount the P/E ratio of quoted companies when using it to value unquoted businesses. This reflects short of management skills, marketability of shares etc.

Consequently a suitable P/E ratio would be 15.9 × 75% ≈ 12.

- One could relate this ratio to last year's earnings of $133000 giving a value of approximately $1.6 million. Nevertheless this figure of $133000 is improbable to be sustainable because

- The car market is depressed

- Most sales are to Nick's personal friends

At most horrible a profit excluding car sales should be used.

$000

Gross profit on garage 40

Dividends 1

Interest (8)

--

33

--

This presents a market value of 12 × 33 = $396000.

- A common technique is to value the buildings independently and charge a market rent when using a P/E ratio.

Revised profit = 33000 - 15000

= $18,000 per annum

∴ Value = 150000 (buildings) + (12 × 18000)

= $366000

The shares in BCA are considered to be trade investments therefore haven't been adjusted in the same way as the buildings.

- This hybrid method for refining the P/E based approach could be taken one step further to give the following.

$000

MV = Value of cars 330

+ Value of building 150

+ Value of the rest of the business 12 × 18,000 216

--

696

--