Duration and Convexity of MBS

A graph decpicting the price of the security under study and the interest rates helps in assessing the duration and convexity.

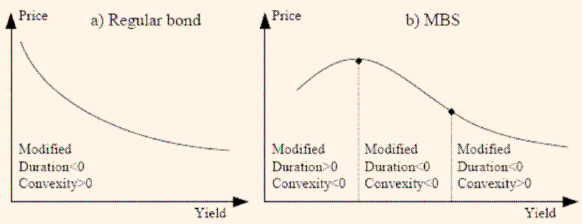

Figure 1: Effect of Prepayment on Duration and Convexity

For each yield, the slope of the price function gives an idea about duration and the curvature of the function gives an idea about the convexity.

Unlike a regular bond, the price of MBS does not rise when interest rates fall. When interest rates fall, cash flows are discounted at a lower interest rate, which should result in a rise in the MBS price. However, owners find refinancing attractive during this time leading to an increase in prepayments. The fractional decrease in the mortgage pool results in lowering the price of the security. The system can be illustrated in detail by conceptually separating the cash flows of mortgage pool into principal repayments and interest payments. While, the mortgagors make their monthly payments, the investors will get payments based on the respective categories. In such a scenario, the kinds of claim vary with the interest rate as depicted in the following diagram.

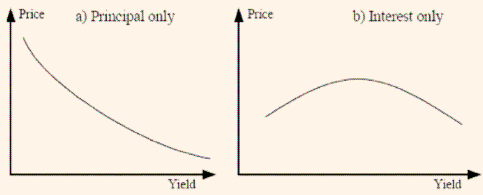

Figure 2: Interest Rate Sensitivity of Prices for Different Tranches

For example, assume that there is a pass-through which has a par value of $100 mn and is backed by long-term mortgages. The PO security is issued at a considerable discount from the par value, say $45mn. The return on this investment is $55mn, although the realized yield depends on the time desirable to recover this amount. The IO on the other hand has no par value. The investor is compensated with the interest on the amount of mortgage principal outstanding.

The value of a PO rises with a fall in interest rates, as with an increase in prepayments, the principal repayments are recovered in a lesser time and the cash-flows are discounted at a lower rate.

The price of IO is affected by two opposite effects. In case of high interest rates, a fall similar to the PO case, increases the present value of the expected interest payments. On the other hand, in times of low interest rates, a further decrease affects the price adversely as prepayments reduce the principal amount on which interest will be paid. In fact, the prepayments are faster when it is difficult for the investor to recover the amount paid. While the present value effect dominates the high yields, the shrinking principal effect is dominant for low yields. Figure 2 shows the relationship between the price of a principal only mortgage, interest only mortgage security, and yield. As the MBS we have taken is a combination of IO and PO, MBS price curve is a vertical addition of IO and PO curves.

It is clear from figure 2 that the payment of an MBS leads to collections of duration and convexity that differ considerably from those of a regular bond. While for high yields, there is negative duration and positive convexity, immediate yields are accompanied by negative duration and negative convexity, intermediate yields are accompanied by negative duration and negative convexity. Low interest rates induce positive duration and negative convexity.