Reference no: EM131672711

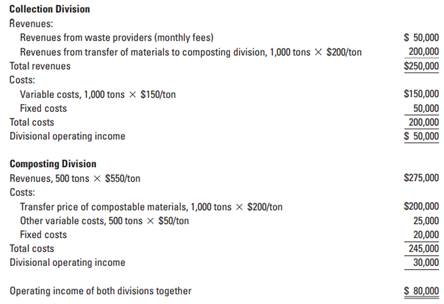

Question: Transfer pricing, full cost and market-based transfer prices. Compost Systems, Inc. (CSI) operates a composting service business and produces organic fertilizer that it sells to farmers in the Midwest. CSI operates with two divisions, collection and composting. The collection division contracts with universities, hospitals, and other large institutions to provide compostable waste collection bins in their dining service areas, and hauls the waste away daily. The waste providers pay the collection division a monthly fee for this service, and the collection division in turn charges the composting division for the compostable materials at a full-cost transfer price of $200 per ton. Monthly, CSI collects and transfers 1,000 tons of waste. The composting division processes the waste, places it in bins, adds microbes to break down the organic material, and ultimately delivers the fertilizer it produces to farmers for use in their fields. After the removal of water, 1,000 tons of waste produces 500 tons of fertilizer. Demand for the fertilizer has risen steeply as consumer demand for organic produce has increased in recent years. Below are key data related to CSI's monthly operations:

The composting division has demand for an additional 200 tons of fertilizer per month. To provide the 400 tons of compostable waste necessary to meet the increased demand, the collection division will have to invest in additional marketing and equipment that will increase monthly fixed costs by $28,000. Estimated additional monthly revenue to the collection division from waste providers is $10,000.

1. Compute the new full-cost transfer price if it is applied to all waste transferred to the composting division.

2. Compute the new full-cost transfer price if it is applied to just the additional 400 tons.

3. What difficulties do you see in using a full-cost transfer-pricing system in the future?

4. The composting division has identified a source of additional compostable waste at a price of $205 per ton. What would be the impact on the company as a whole if the 400 tons of material is purchased from the outside supplier? As a decentralized unit, what decision would the composting division make regarding the additional material?

5. Would a market-based transfer price be agreeable to both divisional managers?

|

Calculate the contribution margin per direct-labor hour

: Calculate the contribution margin per direct-labor hour of selling Xcel-chip and Dcel-chip. If no transfers of Xcel-chip are made to the process-control.

|

|

Components of motivation seems to be most problematic

: Suppose you are a management consultant for a large, suburban hospital. Which of three components of motivation seems to be most problematic in this situation.

|

|

Conduct forecast for pricing or the future labor market

: Identify two Web-based tools that you might use to conduct a forecast for pricing or the future labor market.

|

|

Build a turing machine to compute the binary vigenere cypher

: FIT2014- Show that FA-REP is regular by giving a regular expression for it. Does a UFA exist? Give a proof for your answer

|

|

Would a market-based transfer price be agreeable

: Transfer pricing, full cost and market-based transfer prices. Compost Systems, Inc. (CSI) operates a composting service business and produces organic.

|

|

Describe effect of alternative transfer-pricing methods

: Multinational transfer pricing, effect of alternative transfer-pricing methods, global income tax minimization. Tech Friendly Computer, Inc., with headquarters.

|

|

Briefly describe three characteristics for each of colonies

: briefly describe three characteristics for each of the English colonies located in the South, Middle, and New England regions Now state two religious.

|

|

Review the transfer-pricing problem

: Transfer-pricing problem. Refer to Exercise. Assume that division A can sell the 1,900 units to other customers at $137 per unit, with variable marketing cost.

|

|

List five specific groups that were affected by given event

: List five specific groups that were affected by this event. Provide two examples for each cohort describing how they were affected.

|