Reference no: EM131834646

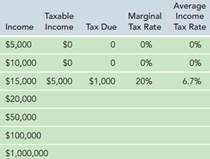

Question: a. Let's explore the difference between the average income tax rate and the marginal income tax rate. In the simple land of Rabushka, there is only one tax rate, 20%, but workers don't have to pay tax on the first $10,000 of their income. For every dollar they earn above $10,000, they pay 20 cents on the dollar to the Lord High Mayor of Rabushka. The easy way to calculate the tax bill is the same way that America's IRS does: Subtract $10,000 from each person's income and call the remainder "taxable income." Multiply taxable income by 0.20, and the result is "tax due." Fill in the table.

b. Is the marginal tax rate ever lower than the average tax rate?

c. As a worker's income rises and rises past $1,000,000, will the average tax rate ever be greater than 20%?

d. Just to make sure you know what these terms mean in plain English: For an accountant making $50,000 per year, what percentage of her income goes to the Lord High Mayor? This simple tax system is quite similar to the plan that economist Robert Hall and political scientist Alvin Rabushka spell out in their book, The Flat Tax, widely available for free online. Hall and Rabushka estimate that a system like this one would raise roughly the same amount of revenue as the current federal income tax.

|

How much cash was received from customers during the year

: How much cash (in $ millions) was received from customers during the year?How much cash (in $ millions) was paid for insurance during the year?

|

|

Two-way contingency table

: Consider a two-way contingency table with three rows and three columns. Suppose that. for i = 1, 2, 3, and j = 1, 2, 3, the probability Pi}

|

|

True for time-varying systems

: For time-invariant systems, show that (A, B) is controllable if and only if (-A, B) is controllable. Is this true for time-varying systems?

|

|

Incident electric field

: A right-hand circularly polarized uniform plane wave traveling in air is incident normally on a flat and smooth water surface with er = 81

|

|

What percentage of income goes to the lord high mayor

: Just to make sure you know what these terms mean in plain English: For an accountant making $50,000 per year, what percentage of her income goes.

|

|

Probability distribution of the discrete random vector

: Consider the probability distribution of the discrete random vector [X,Y] where X represents the number of oders in August

|

|

Probability of two biased coins

: You have two biased coins. Coin A comes up heads with probability ¼. Coin Bcomes up heads with probability ¾.

|

|

What were the principle that miller describe and implemented

: What were the principles that he described and implemented in the course of establishing community-based corrections?

|

|

Discuss about the associated statement of cash flows

: Select which items would be included in presenting the cash flow from operating activities section of the associated statement of cash flows.

|