Reference no: EM131528030

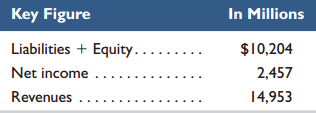

Question: Key financial figures for Research In Motion's fiscal year ended February 27, 2010, follow.

Required: 1. What is the total amount of assets invested in Research In Motion?

2. What is Research In Motion's return on assets? Its assets at February 28, 2009, equal $8,101 (in millions).

3. How much are total expenses for Research In Motion for the year ended February 27, 2010?

4. Does Research In Motion's return on assets seem satisfactory if competitors average an 18% return? Fast Forward

5. Access Research In Motion's financial statements (Form 10-K) for fiscal years ending after February 27, 2010, from its Website (RIM.com) or from the SEC Website (www.sec.gov) and compute its return on assets for those fiscal years. Compare the February 27, 2010, fiscal year-end return on assets to any subsequent years' returns you are able to compute, and interpret the results.

|

Identify the companys strengths weaknesses and opportunities

: Your analysis must identify the company's strengths, weaknesses, opportunities, and threats. Each SWOT category should have approximately 200-300 words.

|

|

Expiration the spot price of wheat-hedger

: At expiration the spot price of wheat is $2.80 per bushel. The hedger has:

|

|

Amazon performance through structure

: Make recommendations for enhancing the Amazon's performance through structure, learning, and organization design practices

|

|

Analyze the way pharmacare uses us law to protect

: Argue for or against Direct-to-Consumer (DTC) marketing by drug companies.Analyze the way PharmaCARE uses U.S. law to protect.

|

|

What is the total amount of assets invested in research

: Key financial figures for Research In Motion's fiscal year ended February 27, 2010, follow.

|

|

Significant and irreversible impact on the world

: Think of a fateful decision that someone has made that has had a significant and irreversible impact on the world.

|

|

The expected return for investment alpha

: Peter owns investment alpha and 1 share of stock bravo. What is X, the expected return for investment Alpha?

|

|

Development of meaningful new insights

: Evaluate which diversity topics continue to challenge you, and which stoke your professional passion - diversity from both professional.

|

|

Christian ethics in particular

: Why do you think the study of ethics in general, and Christian ethics in particular, are vitally important for thinking about business and economic behavior

|