Reference no: EM13864183

Problem 1: Michelo Corporation invested $100,000 to acquire 20,000 shares of Vatsala Technologies on March 1, 2015. On June 3, 2015, Vatsala pays a cash dividend of $0.25 per share. The investment is classified as an available-for-sale investment. How would Michelo record this transaction of June 3 on its books?

A)

|

Cash

|

5,000

|

|

|

Long-term Investments-Trading Investments

|

|

5,000

|

B)

|

Cash

|

5,000

|

|

|

Long-term Investments-Available-for-Sale

|

|

5,000

|

C)

|

Cash

|

5,000

|

|

|

Long-term Investments-Held-to-Maturity

|

|

5,000

|

D)

|

Cash

|

5,000

|

|

|

Dividend Revenue

|

|

5,000

|

Problem 2: What is the effect of receiving a dividend payment on investments classified as available for sale:

A) the total assets will remain unaffected.

B) the long-term assets will decrease.

C) Increase in total Equity .

D) decrease in total liabilities

Problem 3: Maryland Financial Services invested $15,000 to acquire 3,750 shares of Delaware Investments on March 15, 2012. This investment represents less than 20% of the investee's voting stock. On May 7, 2016, Maryland Financial Services sells 1,750 shares for $12,250. When the transaction is recorded in a journal entry:

A) Credit Gain on Disposal .

B) Credit Long-term Investments-Available-for-Sale

C) Credit Cash

D) Debit Long-term Investments-Held-to-Maturity .

Problem 4: Norman Geological Services had previously acquired five thousand shares of treasury stock at $14 per share. It now sells them at $21 per share. The entry to record this transaction will include a

a. credit to Treasury Stock for $100,000.

b. debit to Paid-In Capital from Treasury Stock for $35,000.

c. debit to Treasury Stock for $70,000.

d. credit to Paid-In Capital from Treasury Stock for $35,000.

Problem 5: Peter Corporation pays $500,000 to acquire 40% of the equity securities of Venkat Technologies on May 5, 2015. Which of the following will be included in the journal entry to record this transaction?

A) Debit Long-term Investments-Trading Investments $500,000.

B) Debit Long-term Investments-Venkat Technologies $500,000.

C) Debit Long-term Investments-Available-for-Sale $500,000.

D) Credit Long-term Investments-Available-for-Sale $500,000.

Problem 6: Benjamin Investments purchased 40% of the common stock of Sadie Corporation on March 1, 2013. Sadie Corporation reports a net income of $675,000 for the 2014 year. Which of the following is the correct journal entry?

A)

|

Long-term Investments-Sadie Corporation

|

270,000

|

|

|

Revenue from Investments

|

|

270,000

|

B)

|

Cash

|

270,000

|

|

|

Revenue from Investments

|

|

270,000

|

C)

|

Revenue from Investments

|

270,000

|

|

|

Cash

|

|

270,000

|

D)

|

Revenue from Investments

|

270,000

|

|

|

Long-term Investments-Sadie Corporation

|

|

270,000

|

Problem 7: Benjamin Investments purchased 40% of the common stock of Sadie Corporation on March 1, 2014. Sadie Corporation reports a net income of $675,000 for the 2015 year. Based on the information provided, which of the following is true of the balance sheet on December 31, 2015?

A) Total assets will remain unchanged.

B) Total liabilities will decrease.

C) Total equity will increase.

D) Cash will increase.

Problem 8: Trang Corporation reported trading investments of $15,000 on December 31, 2014. The company realizes a decrease of $3,000 in the fair value of the trading investments by the end of the year 2015. Which of the following is the correct journal entry?

A)

|

Trading Investments

|

3,000

|

|

|

Unrealized Holding Loss-Trading

|

|

3,000

|

B)

|

Unrealized Holding Loss-Trading

|

3,000

|

|

|

Trading Investments

|

|

3,000

|

C)

|

Unrealized Holding Loss-Trading

|

3,000

|

|

|

Fair Value Adjustment-Trading

|

|

3,000

|

D)

|

Fair Value Adjustment-Trading

|

3,000

|

|

|

Unrealized Holding Loss-Trading

|

|

3,000

|

Problem 9: Unrealized holding gain on available-for-sale investments is reported as :

A) stockholders' equity on the balance sheet is adjusted .

B) Debit long-term assets

C) the income statement has a separate line item

D) Credit short-term assets .

Problem 10: Comprehensive income includes:

A) foreign currency translation adjustments

B) owners investments

C) purchase of capital assets

D) payment of dividend

Problem 11: Morgana Engineering reported the balance sheet for the year 2014. What is the rate of return on total assets for Morgana Engineering based on the information below:

|

Total Assets, December 31, 2014

|

$580,682

|

|

Total Assets, December 31, 2013

|

$499,148

|

|

For Year Ended December 31, 2014

|

|

|

Interest Expense

|

$24,352

|

|

Net Income

|

$64,734

|

|

Retained Earnings

|

$ 223,214

|

A) 11.15%

B) 8.21%

C) 16.50%

D) 7.50%

Problem 12: On January 1, 2015, EZ Auto Sales issued $15,000 in bonds for $15,800. They were 10-year bonds with a stated rate of 9%, and pay interest on a semiannual basis. EZ Auto Sales uses the straight-line method to amortize the bond premium. On June 30, 2015, when EZ makes the first payment to bondholders, how much will they report as Interest Expense?

A) $635

B) $675

C) $275

D) $280

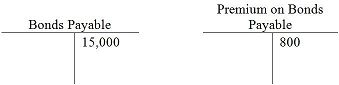

Problem 13: On January 1, 2015, EZ Auto Sales issued $15,000 in bonds for $15,800. They were 8-year bonds with a stated rate of 9%, and pay semiannual interest. EZ Auto Sales uses the straight-line method to amortize the Bond Premium. The following are the balances in the ledger after the bonds are issued

What will be the balance in the Premium Account be after the first interest payment is made on June 30, 2015 ?

A) debit of $50

B) debit of $900

C) credit of $625

D) credit of $750

Problem 14: On January 1, 2013, Johnson Sales issued $15,000 in bonds for $14,300. They were 10-year bonds with a stated rate of 9%, and pay semiannual interest. Johnson Sales uses the straight-line method to amortize the bond discount. After the second interest payment on December 31, 2013, what was the bond carrying amount?

A) $14,388

B) $14,344

C) $15,000

D) $14,370

Problem 15: On November 1, 2015, Brielle Financial Services issued $300,000 of 8-year bonds with a stated rate of 9% at par. The bonds make semiannual payments on April 30 and October 31. At December 31, 2015, Brielle Financial made an adjusting entry to accrue interest at year-end. How much Interest Expense will be recorded at December 31, 2015?

A) $27,000

B) $4,500

C) $13,500

D) $14,200

Problem 16: Blanding Company issues $1,000,000 of 8%, 10-year bonds at 98 on February 28, 2014. The bonds pay interest on February 28 and August 31. The journal entry to record the issuance would include a:

A) debit to Cash for $1,000,000.

B) credit to Bonds Payable for $980,000.

C) credit to Discount on Bonds Payable for $20,000.

D) debit to Cash for $980,000.

Problem 17: Phan Company issues $800,000 of 7%, 10-year bonds on March 31, 2013. The bond pays interest on March 31 and September 30. Which of the following statements is true?

A) If the market rate of interest is 8%, the bonds will issue at a premium.

B) If the market rate of interest is 8%, the bonds will issue at a discount.

C) If the market rate of interest is 8%, the bonds will issue at par.

D) If the market rate of interest is 8%, the bonds will issue above par.

Problem 18: In 2015, its first year of operations Chesapeake Company had the following transactions in 2015.

• Issued 20,000 shares of common stock. Stock has par value of $1.00 per share and was issued at $14.00 per share.

• Issued 1,000 shares of $100 par value preferred stock. Shares were issued at par.

• Earned net income of $35,000.

• Paid no dividends.

• Paid Accounts Payable of $10,215

• Purchased a truck for $10,000. Signed a 5 year promissory note for the entire amount

• Hired a new Vice President on December 15 for a salary of $100,000. The Vice President begins employment on January 3, 2016

At the end of 2015, what is the total amount of stockholders' equity?

A) $415,000

B) $120,000

C) $260,000

D) $380,000

Problem 19: Nottingham Corporation has 10,000 shares of 10%, $75 par noncumulative preferred stock outstanding and 20,000 shares of no-par common stock outstanding. At the end of the current year, the corporation declares a dividend of $180,000. Allocate the dividends between preferred and common stockholders?

A) The dividend is allocated $5,000 to preferred shareholders and $115,000 to common shareholders.

B) The dividend is allocated $75,000 to preferred shareholders and $105,000 to common shareholders.

C) The dividend is allocated $60,000 to preferred shareholders and $120,000 to common shareholders.

D) The dividend is allocated $72,000 to preferred shareholders and $108,000 to common shareholders.

Problem 20: On November 1, 2015, Elli Company declared a dividend of $3.00 per share. Elli Company has 20,000 shares of common stock outstanding and no preferred stock. The date of record is November 15, and the payment date is November 30, 2015. On November 30, Elli made the following journal entry:

A) Debit Retained Earnings $60,000 and credit Dividends Payable-Common $60,000.

B) Debit Dividends Payable-Common $60,000 and credit Cash $60,000.

C) Debit Cash $60,000 and credit Dividends Payable-Common $60,000.

D) Debit Retained Earnings $60,000 and credit Cash $60,000.

Problem 21: Maharaja Corp. was incorporated on January 1, 2012. Maharaja issued 4,000 shares of common stock and 500 shares of preferred stock on that date. The preferred shares are cumulative, $100 par, with an 8% dividend rate. Maharaja has not paid any dividends yet. In 2015, Maharaja had its first profitable year, and on November 1, 2015, Maharaja declared a total dividend of $28,000. The total amount that will be paid out to preferred shareholders is:

A) $4,000

B) $16,000

C) $3,200

D) $28,000

Problem 22: Dr. Jakob's Medical Services originally issued 20,000 shares of $5 par value common stock at $9 per share. The board of directors declares a 5% stock dividend when the market price of the stock is $6 a share. How does Jakob record the declaration of a stock dividend?

A) Retained Earnings is debited for $6,000.

B) Retained Earnings is credited for $6,000.

C) Retained Earnings is debited for $9,000.

D) Paid-in Capital in Excess of Par-Common is credited for $9,000.

Problem 23: Total Stockholders' Equity will decrease by

A) cash dividend declared

B) cash dividend paid

C) stock dividend declared

D) repayment of loan

Problem 24: Norman Company issued $500,000 of 6%, 10-year bonds on one of its interest dates for $431,850 to yield an effective annual rate of 8%. Norman uses the effective-interest method of amortization. Interest is paid annually. What is the amount of discount (to the nearest dollar)that should be amortized for the first interest period?

a. $14,089

b. $6,815

c. $9,096

d. $4,548

Problem 25: Rajiv Services invests its excess cash in Shamina Technologies and acquires 1,000 shares for $53.25. Rajiv Services owns less than 1% of Shamina's voting stock and plans to hold the stock for two years. Which entry below will record this transaction?

A) Long-term Investments-Available-for-Sale will be debited for $53,250.

B) Long-term Investments-Held-to-Maturity will be debited for $53,250.

C) Long-term Investments-Trading Investments will be credited for $53,250.

D) Long-term Investments-Significant Interest Investments will be debited for $53,250.