Reference no: EM13857458

1. Financial derivatives are powerful tools that can be used for managing various types of exposure. However, they are NOT specifically used which of the following?

a. Speculation.

b. Hedging.

c. Human resource management.

d. Arbitrage.

2. A foreign currency ________ contract calls for the future delivery of a standard amount of foreign exchange at a fixed time, place, and price.

a. futures

b. forward

c. option

d. swap

3. Which of the following is NOT a contract specification for currency futures trading on an organized exchange?

a. Size of the contract.

b. Maturity date.

c. Last trading day.

d. Strike price.

4. About ________ of all futures contracts are settled by physical delivery of foreign exchange between buyer and seller.

a. 0%

b. 5%

c. 50%

d. 95%

5. Futures contracts require that traders deposit an initial sum as collateral. This deposit is called a ____________.

a. collateralized deposit

b. marked market sum

c. margin

d. settlement

6. A speculator that has ________ a futures contract has taken a ________ position.

a. sold; long

b. purchased; short

c. sold; short

d. purchased; sold

7. Peter Simpson thinks that the U.K. pound will cost $1.40/£ in six months. A 6-month currency futures contract is available today at a rate of $1.50/£. If Peter was to speculate in the currency futures market, and his expectations are correct, which of the following strategies would earn him a profit?

a. Sell a pound currency futures contract.

b. Buy a pound currency futures contract.

c. Sell pounds today.

d. Sell pounds in six months.

8. Jack Hemmings bought a 3-month British pound futures contract for $1.4400/£ only to see the dollar appreciate to a value of $1.4250 at which time he sold the pound futures. If each pound futures contract is for an amount of £62,500, how much money did Jack gain or lose from his speculation with pound futures?

a. $937.50 gain

b. $937.50 loss

c. £937.50 gain

d. £937.50 loss

9. Which of the following statements regarding currency futures contracts and forward contracts is NOT true?

a. The futures contract is marked to market daily whereas the forward contract is only due to be settled at maturity.

b. The counterparty to the futures participant is unknown with the clearinghouse stepping into each transaction whereas the forward contract participants are in direct contact setting the forward specifications.

c. A single sales commission covers both the purchase and sale of a futures contract whereas there is no specific sales commission with a forward contract because banks earn a profit through the bid-ask spread.

d. A forward contract is for a fixed maturity whereas the futures contract is for any maturity you negotiate for but mostly for up to one year.

10. A foreign currency ________ gives the purchaser the right, not the obligation, to buy a given amount of foreign exchange at a fixed price per unit for a specified period.

a. futures contract

b. forward contract

c. call option

d. put option

11. The price at which an option can be exercised is called the ________.

a. strike price

b. premium

c. spot rate

d. commission

12. An _______ option can be exercised only on its expiration date, whereas an _______ option can be exercised anytime between the date of writing up to and including the expiration date.

a. American; European

b. American; British

c. Asian; American

d. European; American

13. A call option on UK pounds has a strike price of $1.50/£ and a cost of $0.10/£. What is the break-even price for the option?

a. $1.40/£

b. $1.50/£

c. $1.60/£

d. $1.70/£

14. A put option on UK pounds has a strike price of $1.50/£ and a cost of $0.10/£. What is the break-even price for the option?

a. $1.40/£

b. $1.50/£

c. $1.60/£

d. $1.70/£

15. Assume that a call option has an exercise price of $1.50/£. At a spot price of $1.45/£, the call option has ________.

a. a time value of $0.04

b. a time value of $0.00

c. an intrinsic value of $0.00

d. an intrinsic value of -$0.04

16. Assume that a put option has an exercise price of $1.50/£. At a spot price of $1.45/£, the put premium is $0.15/£. The option has _______________.

a. a time value of $0.15.

b. a time value of $0.10.

c. an intrinsic value of $0.15.

d. an intrinsic value of $0.10.

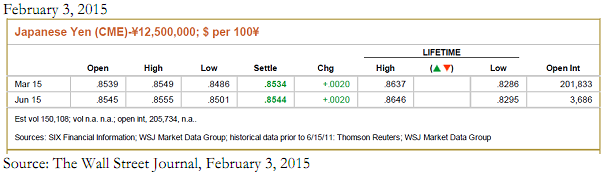

17. Refer to the information below. Suppose you buy one Japanese yen Mar15 futures contract today and the price moves to $0.8634/¥100 tomorrow. How will your account balance change tomorrow (use price in the "Settle" column)?

(Keep two decimals; Do not include currency symbols in your answer; If it is a loss, DO include the "-" sign in your answer)

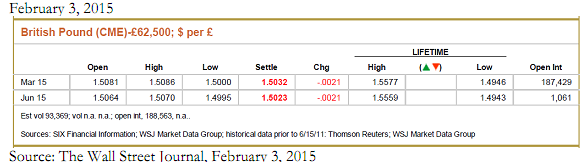

18. Refer to the information below. Suppose you have an A/R of £1 million due in June 2015 (on the same dates as the British pound futures contract matures). The spot price now is $1.5172/£. Which of the following is a description of your hedging strategy using British pound futures?

February 3, 2015

a. Buy 16 Jun15 futures any pay $1.5023 million for £1 million at maturity.

b. Sell 16 Jun15 futures any and receive $1.5023 million for £1 million at maturity.

c. Buy 16 Jun15 futures any pay $1.5172 million for £1 million at maturity.

d. Sell 16 Jun15 futures any and receive $1.5172 million for £1 million at maturity.

19. The table below shows the call and put prices at various strike prices for the Australian dollar on February 2, 2015 for maturity in March 2015 (The underlying asset is the Mar15 Australian futures contract, so it has the same maturity date as the Mar15 Australian dollar futures). The option contract size is AUD$100,000 per contract. The prices in the table are in dollars per AUD$ (for example, 0.0298 means $0.0298/AUD$). The strike price of "7550" should read as $0.7550/AUD$.

| Call |

Strike Price |

Put |

| 0.0298 |

7550 |

0.0063 |

| 0.0261 |

7600 |

0.0076 |

| 0.0226 |

7650 |

0.0091 |

| 0.0193 |

7700 |

0.0108 |

| 0.0164 |

7750 |

0.0129 |

| 0.0136 |

7800 |

0.0151 |

| 0.0112 |

7850 |

0.0177 |

| 0.0091 |

7900 |

0.0206 |

| 0.0073 |

7950 |

0.0238 |

| 0.0057 |

8000 |

0.0272 |

If you have to fulfill your debt obligation of AUD$1,000,000 in March 2015 (on the same date as the maturity date of the options), and you decide to use an option with a strike price of "7600" to hedge your position. What is the maximum potential cost per AUD$ when purchase AUD$ at maturity?

20. The table below shows the call and put premiums at various strike prices for the Australian dollar on February 2, 2015 for maturity in March 2015 (The underlying asset is the Mar15 Australian futures contract, so it has the same maturity date as the Mar15 Australian dollar futures). The option contract size is AUD$100,000 per contract. The prices in the table are in dollars per AUD$ (for example, 0.0298 means $0.0298/AUD$). The strike price of "7550" should read as $0.7550/AUD$.

| Call |

Strike Price |

Put |

| 0.0298 |

7550 |

0.0063 |

| 0.0261 |

7600 |

0.0076 |

| 0.0226 |

7650 |

0.0091 |

| 0.0193 |

7700 |

0.0108 |

| 0.0164 |

7750 |

0.0129 |

| 0.0136 |

7800 |

0.0151 |

| 0.0112 |

7850 |

0.0177 |

| 0.0091 |

7900 |

0.0206 |

| 0.0073 |

7950 |

0.0238 |

| 0.0057 |

8000 |

0.0272 |

If your client will pay you AUD$1,000,000 in March 2015 (on the same date as the maturity date of the options), and you decide to use an option with a strike price of "8000" to hedge your position. What is the minimum potential proceeds per AUD$ when collect the AUD$

payment at maturity?