Reference no: EM13912602

1. Which of the following is included in the cost of constructing a building?

Insurance costs during construction

Cost of paving parking lot

Cost of repairing vandalism damage during construction

Cost of removing the demolished building existing on the land when it was purchased

2. A used machine with a purchase price of $77,000, requiring an overhaul costing $8,000, installation costs of $5,000, and special acquisition fees of $3,000, would have a cost basis of

$93,000

$90,000

$82,000

$85,000

3. The journal entry for recording an operating lease payment would

Be a memo entry only

Debit the fixed asset and credit Cash

Debit an expense and credit Cash

Debit a liability and credit Cash

4. A machine with a cost of $80,000 has an estimated residual value of $5,000 and an estimated life of 5 years or 15,000 hours. It is to be depreciated by the units-of-production method. What is the amount of depreciation for the second full year, during which the machine was used 5,000 hours?

$5,000

$25,000

$15,000

$26,667

5. A machine with a cost of $75,000 has an estimated residual value of $5,000 and an estimated life of 4 years or 18,000 hours. What is the amount of depreciation for the second full year, using the double declining-balance method?

$17,500

$37,500

$18,750

$16,667

6. Equipment with a cost of $160,000, an estimated residual value of $40,000, and an estimated life of 15 years was depreciated by the straight-line method for 4 years. Due to obsolescence, it was determined that the useful life should be shortened by 3 years and the residual value changed to zero. The depreciation expense for the current and future years is

$11,636

$16,000

$11,000

$8,000

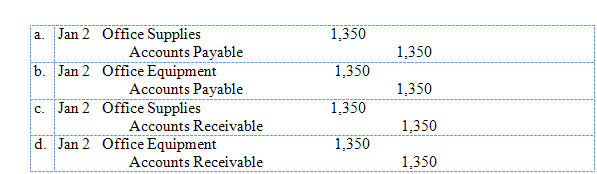

7. The proper journal entry to purchase a computer on account to be utilized within the business would be:

8. Expected useful life is

Calculated when the asset is sold.

Estimated at the time that the asset is placed in service.

Determined each year that the depreciation calculation is made.

None of the answers are correct.

9. Which of the following is true?

If using the double-declining-balance the total amount of depreciation expense during the life of the asset will be the highest.

If using the units-of-production method, it is possible to depreciate more than the depreciable cost.

If using the straight line method, the amount of depreciation expense during the first year is higher than that of the double-declining-balance.

Regardless of the depreciation method, the amount of total depreciation expense during the life of the asset will be the same.

10. A fixed asset with a cost of $52,000 and accumulated depreciation of $47,500 is traded for a similar asset priced at $60,000. Assuming a trade-in allowance of $5,000, the cost basis of the new asset is

$54,000

$59,500

$60,000

$60,500

11. A fixed asset with a cost of $41,000 and accumulated depreciation of $36,500 is traded for a similar asset priced at $60,000. Assuming a trade-in allowance of $3,000, the recognized loss on the trade is

$3,000

$4,500

$ 500

$1,500

12. A fixed asset with a cost of $30,000 and accumulated depreciation of $28,500 is sold for $3,500. What is the amount of the gain or loss on disposal of the fixed asset?

$2,000 loss

$1,500 loss

$3,500 gain

$2,000 gain

13. When a company discards machinery that is fully depreciated, this transaction would be recorded with the following entry

Debit Accumulated Depreciation; credit Machinery

Debit Machinery; credit Accumulated Depreciation

Debit Cash; credit Accumulated Depreciation

Debit Depreciation Expense; credit Accumulated Depreciation

14. When a company replaces a component of property, plant and equipment, which statement below does not account for one of the steps to this process?

Book value of the replaced component is written off to depreciation expense

The asset cost of the replaced component is credited

Any cost to remove the old component is charged to expense

The identifiable direct costs associated with the new component are capitalized

15. Expenditures for research and development are generally recorded as

Current operating expenses

Assets and amortized over their estimated useful life

Assets and amortized over 40 years

Current assets

16. Xtra Company purchased goodwill from Argus for $144,000. Argus had developed the goodwill over 6 years. How much would Xtra amortize the goodwill for its first year?

$8,640

$24,000

Goodwill is not amortized.

Not enough information.

17. Which intangible assets are amortized over their useful life?

Trademarks

Goodwill

Patents

All of the above