Reference no: EM13381014

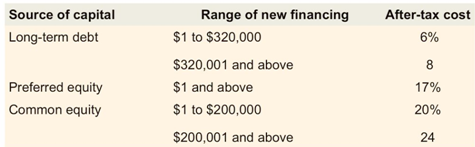

WACC, MCC, and IOS Cartwell Products has compiled the data shown in the following table for the current costs of its three sources of capital-long-term debt, preferred equity, and common equity-for various ranges of new financing.

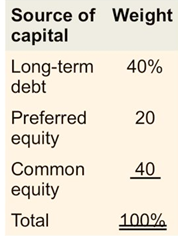

The company's optimal capital structure, which is used to calculate the weighted average cost of capital, is shown in the following table.

a. Determine the break points and ranges of new financing associated with each source of capital. At what financing levels will Cartwell's weighted average cost of capital change?

b. Calculate the weighted average cost of capital for each range of total new financing found in a. (Hint: There are three ranges.)

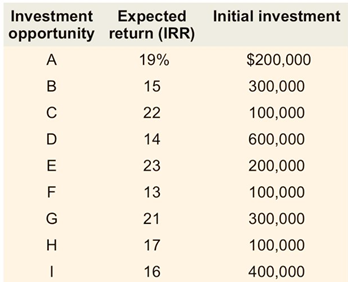

c. Using the results of b along with the following information on the available investment opportunities, draw the firm's marginal cost of capital (MCC) schedule and investment opportunities schedule (IOS).

d. Which, if any, of the available investments do you recommend that the firmselect? Explain your answer.

e. Now calculate the overall cost of capital for Cartwell Products. Which projects should the firm select? Does your answer differ from your answer topart d? If so, explain why.