Reference no: EM13333520

Sidney Rabinovitch, a client of long standing, has operated a business as a sole proprietor since 1996. Net business income has increased progressively and is presently approximately $90,000. Due to the reduced tax rates on the ABI of CCPCs, you have discussed the possibility of reducing his income taxes by transferring his business to a corporation.

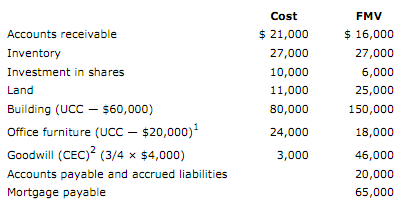

Based on your discussions, Sidney forms a new corporation. Sidney owns 100% of the common shares of this new corporation. Sidney decides to transfer all of his business assets to the new corporation. In your file, you find the following list of the assets and liabilities of the business as at January 31, 2011, the date of the fiscal year end.

1. Assume that there is only one property in the class.

2. Assume that no amount was deducted under paragraph 20(1)(b).

On February 1, 2011, Sidney sells all his business assets to the new corporation for a price equal to FMV. The new corporation assumes all of Sidney's business liabilities. The new corporation's fiscal period will end on May 31.

Required

Plan the sale of assets by Sidney to the new corporation in such a way that he has minimum tax consequences and receives the maximum amount of non-share consideration without any immediate tax liability. If shares are to be issued as consideration, assume that they are non-voting retractable preferred shares, of a class in which no share is currently issued and with a legal capital and redemption value of $1 each.

a. Select the agreed amount or POD for each class of property and explain the tax consequences for Sidney, if any. In addition, use a table presented as follows for property transferred under section 85:

b. Specify the cost and ACB of the consideration received by Sidney.

c. Specify the PUC of the shares received by Sidney.

d. Indicate the cost of the property acquired by the new corporation.

e. Specify the deadline for the filing of the election form.

f. Assume that it is now November 2015, and Sidney has asked you to review his tax files for the last several years. You discover that George Saint-Jean, who is one of your partners in the firm and who advised Sidney on this transaction, still hasn't filed Form T2057 for the rollover of the business to the corporation. Write an internal memorandum to your partners in which you discuss George's conduct, setting out possible solutions and making recommendations on how the firm should proceed, including what it should do in relation to the client and George.