Reference no: EM13333516

During 2011, Mary Todd transferred land to Sandy Development Ltd., a newly created corporation. The land was acquired a few years ago in order to build an income property on it. Mary is the sole shareholder of Sandy Development Ltd. The FMV of the land at the time of the transfer was $500,000 and its ACB was $120,000. Mary has a net capital loss carryforward of $25,000 (based on a 50% inclusion rate).

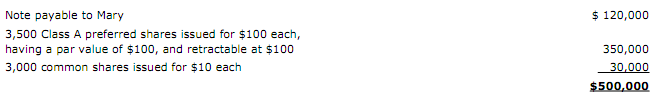

Mary received the following consideration in the transfer:

No Class A preferred or common shares were issued prior to the transfer and no other shares have been issued since.

Mary comes to consult you on the tax consequences of the transfer. She was told that it was possible to make an election for tax purposes so that there would be no tax consequences on the transfer. Mary gives you all the information with no verification on your part.

Required

a. In a letter addressed to Mary, give her your opinion on how the transfer should be carried out under subsection 85(1) so that she will have no immediate tax consequences and will benefit from all the available tax attributes. You should also tell her the PUC and ACB of the Class A preferred shares and the common shares that she has received and deal with the tax consequences on the eventual redemption of the 3,500 Class A preferred shares.

Mary informs you that in 2013, she will make a capital contribution of $100,000 to Sandy Development Ltd. to enable it to purchase and develop other pieces of land. The banker for the corporation requires that the contribution be made in the form of a share issue and not in the form of a loan made by Mary to the corporation. What recommendation will you make to Mary in order for her to be able to withdraw the $100,000 without future tax consequences?

|

Specify cost and acb of consideration received by sidney

: Plan the sale of assets by Sidney to the new corporation in such a way that he has minimum tax consequences and receives the maximum amount of non-share consideration without any immediate tax liability

|

|

Define the concentrations of all species at equilibrium

: Calculate the concentrations of all species at equilibrium for each of the following cases. (b) 1.0 mol pure HOCl is placed in a 2.9-L flask. exact answer only please.

|

|

What is the decrease in kinetic energy of the bullet

: A 5.00-g bullet, traveling horizontally with a velocity of magnitude 360 m/s, is fired into a wooden block with mass 0.800 kg, initially at rest on a level surface. What is the decrease in kinetic energy of the bullet

|

|

Find out the mass of ne gas in container b

: Two gas reservoirs, A and B, have the same volume and contain gas at the same temperature. Reservoir A contains 7.62g of He gas at a pressure of 1.20atm. Reservoir B cotains Ne gas at a pressure of 1.80atm. Determine the mass of Ne gas in containe..

|

|

Tax consequences on the eventual redemption

: You should also tell her the PUC and ACB of the Class A preferred shares and the common shares that she has received and deal with the tax consequences on the eventual redemption of the 3,500 Class A preferred shares.

|

|

What was the speed of the lighter car

: When cars are equipped with flexible bumpers, they will bounce off each other during low-speed collisions, thus causing less damage. What was the speed of the lighter car just after the collision

|

|

Calculate the variances of returns for fc and mc

: Florida Company (FC) and Minnesota Company (MC) are both service companies. Their stock returns for the past three years were: FC: -5%, 15%, 20%; MC: 8%, 8%, 20%.Calculate the variances of returns for FC and MC.

|

|

What was the speed of puck before the collision

: On a frictionless, horizontal air table, puck A (with mass 0.250 kg) is moving toward puck B (with mass 0.370 kg), which is initially at rest. What was the speed of puck A before the collision

|