Reference no: EM132090307

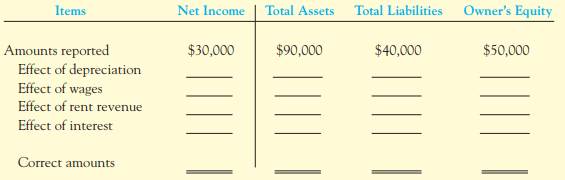

Question: Analyzing the Effects of Adjusting Journal Entries on the Income Statement and Balance Sheet On December 31, 2009, Laura's Pie Company, owned by Laura Anne, prepared an income statement and balance sheet, but the bookkeeper accidentally failed to take into account four adjusting journal entries. The income statement, prepared on this incorrect basis, reported income of $30,000. The balance sheet reflected total assets, $90,000; total liabilities, $40,000; and owner's equity, $50,000. The data for the four adjusting journal entries follow:

a. Depreciation of $8,000 for the year on equipment was not recorded.

b. Wages amounting to $17,000 for the last three days of December 2009 were not paid and not recorded (the next payroll will be on January 10, 2010).

c. Rent revenue of $4,800 was collected on December 1, 2009, for office space for the three month period December 1, 2009, to February 28, 2010. The $4,800 was credited in full to Unearned Rent Revenue when collected.

d. The company borrowed $10,000 from a local bank on January 1, 2009. The note principal is due in three years but requires payment of $1,500 interest every January 1 with the next payment due on January 1, 2010. No interest has been paid or recorded for 2009.

Required: Complete the following table to show the effects of the four adjusting journal entries (indicate deductions with parentheses):

|

Top management of a large company

: Top management of a large company has told you that they really would like to be able to determine what the impact of years of service at their company

|

|

Determining adjustments and accounting equation

: Determining Adjustments and Accounting Equation Effects Mary Fes, owner of Fes Company, has hired you to help with the accounting entries.

|

|

Describe the typical transactions

: Inferring Transactions from Accrual Accounts Deere & Company was incorporated in 1868 and today is the world's leading producer of agricultural equipment.

|

|

Sales dollar achieved as result of the advertising

: What was the the cost to the retailer per incremental sales dollar achieved as a result of the advertising?

|

|

Show the effects of the four adjusting journal entries

: Analyzing the Effects of Adjusting Journal Entries on the Income Statement and Balance Sheet On December 31, 2009, Laura's Pie Company, owned by Laura Anne.

|

|

Discuss some ways to improve quality in operations

: Discuss some ways to improve quality in operations. What are the ways that you can protect intellectual property rights?

|

|

What is he or she telling you about the output information

: What is he or she telling you about the output information, and why is it important?

|

|

Prepare a classified income statement using adjusted amounts

: Reporting an Adjusted Income Statement Dyer Rental Store, a sole proprietorship owned by Jessica Dyer, completed its first year of operations on December 31.

|

|

Predicting a father education level

: Write a brief paper in APA format of 400-600 words that respond to the following questions with your thoughts, ideas, and comments.

|