Reference no: EM131863329

Question: 1. Parent Corp ltd acquires all of Subsidiary Corp ltd. outstanding common Stock for $ 300,000 in 2016, equal with the fair value of Subsidiary Corp ltd as a whole. Fair Value of Subsidiary Corp ltd individual assets and liabilities are equal with its book value. The balance sheets show that the total book value of the share acquired equals the total stakeholder's equity of Subsidiary Corp ltd ($200,000+$100,000). Pass the necessary journal entries and prepare the consolidated balance sheet after necessary eliminations.

|

|

Parent Corp ltd

|

Subsidiary Corp ltd

|

|

Assets

|

|

|

|

Cash

|

50,000

|

50,000

|

|

Accounts Receivable

|

75,000

|

50,000

|

|

Inventory

|

100,000

|

60,000

|

|

Land

|

175,000

|

40,000

|

|

Building and Equipment

|

800,000

|

600,000

|

|

Accumulated Depreciation

|

(400,000)

|

(300,000)

|

|

Investment in Subsidiary Corp Ltd

|

300,000

|

|

|

Total Assets

|

1,100,000

|

500,000

|

|

Liabilities and Stockholder's Equity

|

|

|

|

Accounts Payable

|

100,000

|

100,000

|

|

Bonds Payable

|

200,000

|

100,000

|

|

Common Stock

|

500,000

|

200,000

|

|

Retained earnings

|

300,000

|

100,000

|

|

Total Liabilities and Equity

|

1,100,000

|

500,000

|

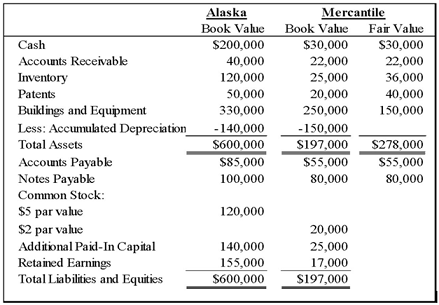

2. On January 1, 20X8, Alaska Corporation acquired Mercantile Corporation's net assets by paying $160,000 cash. Balance sheet data for the two companies and fair value information for Mercantile Corporation immediately before the business combination are given below:

Required: Prepare the journal entry to record the acquisition of Mercantile Corporation. [3 marks]

3. ABC Company purchased 35 percent ownership of XYZ Company on January 1,2009,for $140,000. XYZ reported 2009 net income of 80,000 and paid dividends of $20,000.At December 31st, 2009ABC determined the fair value of its investment in XYZ to be $174,000.

Required: Give all journalentries recorded by ABC with respect to its investments in XYZ in 2009 assuming it uses

a. The Equity method.

b. The Fair value method.