Reference no: EM132312738

Corporate Accounting and Reporting Assignment - Report on Financial Statements and Calculations

Purpose - To allow students to demonstrate their ability to related corporate accounting concepts and applying their understanding of accounting standards AASB 3, AASB 10, and AASB 12. Students will be required to complete complex calculation and journal entries for business combinations, consolidation and other relevant accounting standards.

Topic - Consolidation worksheet

Ethan Ltd acquired all the issued shares (ex div.) of Darren Ltd on 1 July 2017 for $110 000. At this date Darren Ltd recorded a dividend payable of $10 000 and equity of:

|

Share capital

|

$54 000

|

|

Retained earnings

|

36 000

|

|

Asset revaluation surplus

|

18 000

|

All the identifiable assets and liabilities of Darren Ltd were recorded at amounts equal to their fair values at acquisition date except for:

|

|

Carrying amount

|

Fair value

|

|

Inventories

|

$14 000

|

$16 000

|

|

Machinery (cost $100 000)

|

92 500

|

94 000

|

The machinery was considered to have a further 5-year life. Of the inventory, 90% was sold by 30 June 2018. The remainder was sold by 30 June 2019.

Both Darren Ltd and Ethan Ltd use the valuation method to measure the land. At 1 July 2017, the balance of Ethan Ltd's asset revaluation surplus was $13 500.

In May 2018, Darren Ltd transferred $3000 from the retained earnings at 1 July 2017 to a general reserve.

The tax rate is 30%.

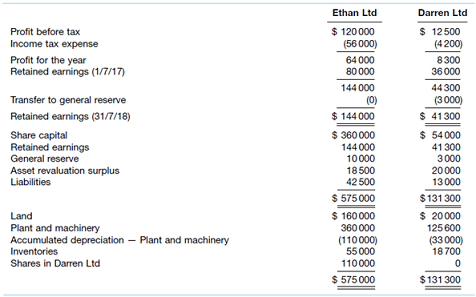

The following information was provided by the two companies at 30 June 2018.

Required: Prepare the consolidated financial statements of Ethan Ltd at 30 June 2018.

1- Acquisition Analysis at 30 June 2018.

2- Worksheet Adjustment journal entries at 30 June 2018.

3- Complete Worksheet.

Show the acquisition analysis and consolidation journal entries including business combination valuation reserve entries and pre-acquisition journal entries.