Reference no: EM131532862

Question: On July 1, 2011, Lucinda Fogle created a new self-storage business, KeepSafe Co. The following transactions occurred during the company's first month. July 1 Fogle invested $20,000 cash and buildings worth $120,000 in the company.

2 The company rented equipment by paying $1,800 cash for the first month's (July) rent.

5 The company purchased $2,300 of office supplies for cash.

10 The company paid $5,400 cash for the premium on a 12-month insurance policy. Coverage begins on July 11.

14 The company paid an employee $900 cash for two weeks' salary earned.

24 The company collected $8,800 cash for storage fees from customers. 28 The company paid $900 cash for two weeks' salary earned by an employee.

29 The company paid $850 cash for minor repairs to a leaking roof.

30 The company paid $300 cash for this month's telephone bill.

31 Fogle withdrew $1,600 cash from the company for personal use.

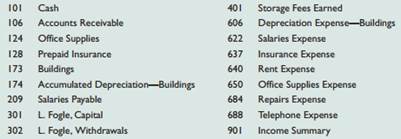

Required: 1. Use the balance column format to set up each ledger account listed in its chart of accounts.

2. Prepare journal entries to record the transactions for July and post them to the ledger accounts. Record prepaid and unearned items in balance sheet accounts.

3. Prepare an unadjusted trial balance as of July 31.

4. Use the following information to journalize and post adjusting entries for the month:

a. Two-thirds of one month's insurance coverage has expired.

b. At the end of the month, $1,550 of office supplies are still available.

c. This month's depreciation on the buildings is $1,200.

d. An employee earned $180 of unpaid and unrecorded salary as of month-end.

e. The company earned $950 of storage fees that are not yet billed at month-end.

5. Prepare the income statement and the statement of owner's equity for the month of July and the balance sheet at July 31, 2011.

6. Prepare journal entries to close the temporary accounts and post these entries to the ledger.

7. Prepare a post-closing trial balance.

|

Calculate the mean-median-mode-range and standard deviation

: Calculate the mean, median, mode, range, and standard deviation of the adjusted daily closing price for this stock.

|

|

The difference between a permutation and a combination

: Explain the difference between a standard deviation and the standard error of the mean, and why the standard error is smaller.

|

|

Describe the role and value of ethics in policing

: Describe the role and value of ethics in policing. Identify the punishment or consequences of the unethical police practices

|

|

Based on the five forces model

: Based on the Five Forces Model, please answer these discussion questions based on the following scenario:

|

|

Prepare journal entries to close the temporary accounts

: On July 1, 2011, Lucinda Fogle created a new self-storage business, KeepSafe Co. The following transactions occurred during the company's first month.

|

|

Discuss the various defenses available under the chosen tort

: Discuss the various defenses available under the chosen tort. If you state the law in your response, be sure to cite your source of information.

|

|

Determining the portfolio project

: Please respond to EACH of the following discussion topics and submit them to the discussion forum as a single post. Your initial post should be 75-150 words.

|

|

What remedies are available to the client

: What remedies are available to the client under the United Nations Convention for the International Sale of Goods

|

|

Evaluate whether this is good use of government funds

: The government’s environmental protection agency uses a discount rate of 2% to evaluate whether this is a good use of government funds.

|