Reference no: EM132090283

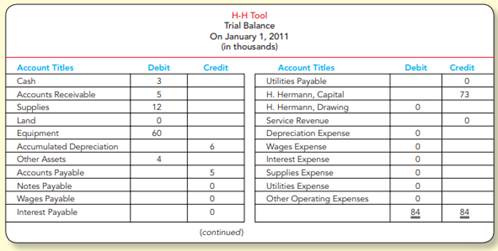

Question: Recording Transactions (including adjusting journal entries), Preparing Financial Statements, Closing the Books, and Analyzing a Key Ratio: Comprehensive Review Problem (Chapters 2, 3, and 4) Harry Hermann began operations of his machine shop (H-H Tool) on January 1, 2009. The annual reporting period ends December 31. The trial balance on January 1, 2011, follows (the amounts are rounded to thousands of dollars to simplify):

Transactions during 2011 (summarized in thousands of dollars) follow:

a. Borrowed $12 cash on a short-term note payable dated March 1, 2011.

b. Purchased land for future building site, paid cash, $9.

c. Earned $160 in Service Revenue for 2011, including $40 on credit and $120 collected in cash.

d. Received an additional $3 investment by H. Hermann.

e. Recognized $70 in Wages Expense for 2011, paid in cash, and $15 of Other Operating Expenses on credit.

f. Collected accounts receivable from customers, $24.

g. Purchased other assets, $10 cash.

h. Paid accounts payable, $13.

i. Purchased supplies on account for future use, $18.

j. Signed a $25 service contract to start February 1, 2012.

k. Paid $17 cash to H. Hermann on his drawing account. Data for adjusting journal entries follow:

l. Supplies counted on December 31, 2011, $10.

m. Depreciation for the year on the equipment, $6.

n. Accrued interest on notes payable, $1.

o. Wages earned by employees since the December 24 payroll not yet paid, $12.

p. Utility bill of $8 for December usage was received on December 31, 2011. It will be paid in 2012.

Required: 1. Set up T-accounts for the accounts on the trial balance and enter beginning balances.

2. Record journal entries for transactions ( a) through ( k) and post them to the T-accounts.

3. Prepare an unadjusted trial balance.

4. Record and post the adjusting journal entries ( l) through ( p).

5. Prepare an adjusted trial balance.

6. Prepare a classified income statement, statement of owner's equity, and classified balance sheet.

7. Prepare and post the closing journal entries.

8. Prepare a post-closing trial balance.

9. How much net income did H-H Tool generate during 2011? Is the company financed primarily by debt or equity?

10. Compute and interpret the net profit margin for H-H Tool for the year ended December 31, 2011.