Reference no: EM131537868

Question: Scott and King, who occupied adjacent shops, became partners as from 1st January, 1962. Capital contributed was:

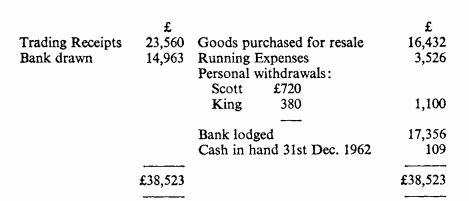

The partnership agreement provided that profits should be shared threefifths to Scott and two-fifths to King, after provision for salaries at the annual rate of £630 to Scott and £420 to King and interest on the foregoing capitals introduced at 6% per annum. The cash account of the combined business for the year ending 31st December, 1962 was as follows:

King died on 31st August, 1962, and the balance found due to him as at the date of his death based on the accounts for year ending 31st December, 1962, had to carry interest at the rate of 5% per annum until paid over to his executors. The amount due on death had to include £1,000 for Goodwill payable by the remaining partner. Prepare accounts for the year ending 31st December, 1962, making provision for the

following additional items:

Depreciation on shop property 5 %

Depreciation on fittings 10%

Stocks on hand at 31st December, 1962 £4,360

Expenses outstanding £244

Creditors for goods purchased for resale £484

(Calculations to nearest £1 and month).

|

Analyze how you see the principles expressed

: Assignment- Explain how you see the principles expressed in the statements manifested in each company's public reputation.

|

|

What does it mean to be healthy

: What does it mean to be healthy? What does it mean for the body to react abnormally to a disease or illness? What does it look like

|

|

Draw up statements to show amounts

: A, ? and C are in partnership at Exton and Wyeton sharing profits in the ratio 4:4:2 . Their Balance Sheet at 31st December, 1962.

|

|

Identifies the professional area of psychology it represents

: Assesses the roles of psychology professionals within this area and describes whether or not the article clearly and correctly represents these roles

|

|

Prepare accounts for the year ending

: Scott and King, who occupied adjacent shops, became partners as from 1st January, 1962. Capital contributed was.

|

|

Analyze hazards posed by interaction of hazardous materials

: Discuss the hazards posed by the interaction of the hazardous materials present at the refinery and adjacent facilities, including the resulting by-products of

|

|

The positioning strategy for each of these physician

: Describe in detail the positioning strategy for each of these physician groups.

|

|

What are some strengths and weaknesses of the proposal

: Do you believe the proposal would be approved if formally proposed? What are some strengths and weaknesses of the proposal

|

|

Discuss and the influence this problem has on land

: Problem identification: Clearly indicate the issue you will discuss and the influence this problem has on land, air, water resources, plant life, animal life

|