Reference no: EM131534813

Question: Patton issues $650,000 of 5%, four-year bonds dated January 1, 2011, that pay interest semiannually on June 30 and December 31. They are issued at $584,361 and their market rate is 8% at the issue date.

Required: 1. Prepare the January 1, 2011, journal entry to record the bonds' issuance.

2. Determine the total bond interest expense to be recognized over the bonds' life.

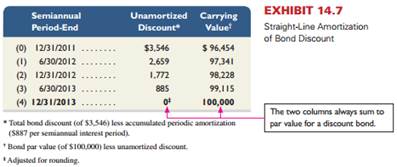

3. Prepare a straight-line amortization table like the one in Exhibit for the bonds' first two years.

4. Prepare the journal entries to record the first two interest payments.

Analysis Component

5. Assume the market rate on January 1, 2011, is 4% instead of 8%. Without providing numbers, describe how this change affects the amounts reported on Patton's financial statements.

|

Determine the total bond interest expense

: McFad issues $90,000 of 11%, three-year bonds dated January 1, 2011, that pay interest semiannually on June 30 and December 31. They are issued at $92,283.

|

|

Measure the process to determine current performance

: Define the project goals and customer (internal and external) deliverables.Measure the process to determine current performance.

|

|

Potential psychological impact of price reductions

: Advise WFM on the various approaches that could be taken to reducing price. Be sure to consider potential psychological impact of price reductions on WFM.

|

|

Describe how you plan to utilize and implement evidence

: Describe how you plan to utilize and implement evidence-based practice protocols found from the Agency for Healthcare Research and Quality to ensure competent a

|

|

Prepare a straight-line amortization table

: Patton issues $650,000 of 5%, four-year bonds dated January 1, 2011, that pay interest semiannually on June 30 and December 31.

|

|

Marketing campaign a success

: What roles does the top-level management play in making a marketing campaign a success?

|

|

Describe the erroneous assumptions of racial profiling

: Describe the erroneous assumptions of racial profiling. Explain how public hysteria and self-fulfilling prophecies influence opinions and racial profiles

|

|

Prepare the journal entry to record montana capital lease

: Montana Company signs a five-year capital lease with Elway Company for office equipment. The annual lease payment is $20,000, and the interest rate is 8%.

|

|

What is the use of case studies

: What is the use of case studies and how do they add value to marketing?

|