Reference no: EM131693716

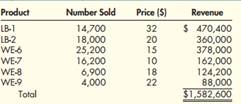

Question: Sales Budget Alger Inc. manufactures six models of leaf blowers and weed eaters. Alger's budgeting team is finalizing the sales budget for the coming year. Sales in units and dollars for last year follow:

In looking over the previous year's sales figures, Alger's sales budgeting team recalled the following:

a. Model LB-1 is a newer version of the leaf blower with a gasoline engine. The LB-1 is mounted on wheels instead of being carried. This model is designed for the commercial market and did better than expected in its first year. As a result, the number of units of Model LB-1 to be sold was forecast at 250 percent of the previous year's units.

b. Models WE-8 and WE-9 were introduced on July 1 of last year. They are lighter versions of the traditional weed eater and are designed for smaller households or condo units. Alger estimates that demand for both models will continue at the previous year's rate.

c. A competitor has announced plans to introduce an improved version of model WE-6, Alger's traditional weed eater. Alger believes that the model WE-6 price must be cut 30 percent to maintain unit sales at the previous year's level.

d. It was assumed that unit sales of all other models would increase by 5 percent, prices remaining constant.

Required: Prepare a sales budget by product and in total for Alger Inc. for the coming year.