Reference no: EM131003475

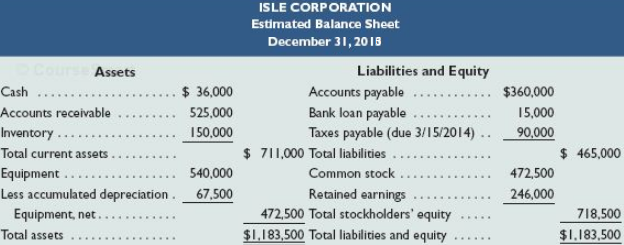

Near the end of 2015, the management of Isle Corp., a merchandising company, prepared the following estimated balance sheet for December 31, 2015.

To prepare the master budget for January, February and March of 2016, management gathers the following information

a. Isle Corp.'s single product is purchased for $30 per unit and resold for $45 per unit. The expected inventory level of 5,000 units on December 31, 2015, is more than management's desired level for 2015, which is 25% of the next month's expected sales (in units).

Expected sales are: January, 6,000 units; February, 8,000 units; March, 10,000 units; and April, 9,000 units.

b. Cash sales and credit sales represent 25% and 75%, respectively, of total sales. Of the credit sales, 60% is collected in the first month after the month of sale and 40% in the second month after the month of sale. For the $525,000 accounts receivable balance at December 31, 2015, $315,000 is collected in January 2016 and the remaining $210,000 is collected in February 2016.

c. Merchandise purchases are paid for as follows: 20% in the first month after the month of purchase and 80% in the second month after the month of purchase. For the $360,000 accounts payable balance at December 31, 2015, $72,000 is paid in January 2016 and the remaining $288,000 is paid in February 2016.

d. Sales commissions equal to 20% of sales are paid each month. Sales salaries (excluding commissions) are $90,000 per year.

e. General and administrative salaries are $144,000 per year. Maintenance expense equals $3,000 per month and is paid in cash.

f. Equipment reported in the December 31, 2015 balance sheet was purchased in January 2015. It is being depreciated over 8 years under the straight-line method with no salvage value. The following amounts for new equipment purchases are planned in the coming quarter:

January, $72,000; February, $96,000; and March, $28,800. This equipment will be depreciated using the straight-line method over 8 years with no salvage value. A full month's depreciation is taken for the month in which equipment is purchased.

g. The company plans to acquire land at the end of March at a cost of $150,000, which will be paid with cash on the last day of the month.

h. Isle Corp. has a working arrangement with its bank to obtain additional loans as needed. The interest rate is 12% per year, and interest is paid at each month-end based on the beginning balance. Partial or full payments on these loans can be made o the last day of the month. Isle has agreed to maintain a minimum ending cash balance of $36,000 in each month.

i. The income ta rate for the company is 40%. Income taxes on the first quarter's income will not be paid until April 15.

Prepare a master budget for the first three months of 2016. Round to the nearest dollar.

|

Walmart reported as a noncurrent liability

: In its 2009 balance sheet, Walmart reported as a noncurrent liability, "Deferred income taxes" of $3,076 million. Why is this different from the $1,605 million "net deferred tax liability" reported in the disclosure note?

|

|

Use the theory of economic development

: Essay Question: Use the Theory of Economic Development to explain transformations in the US economy today. You will need to do some additional research to discover some examples to illuminate that theory

|

|

The publishers clearing house is awarding a prize

: The Publishers Clearing House is awarding a prize of $5000/week for the rest of your life that can then be transferred to someone you nominate (and so on). How much does the Publishers Clearing House has to deposit now (P) if yearly interest (APR = n..

|

|

Why is care should be exercised in using transfers

: Why is Care should be exercised in using transfers or reassignments to deal with harassment. good legal advice

|

|

Prepare a master budget for the first three months of 2016

: Near the end of 2015, the management of Isle Corp., a merchandising company, prepared the following estimated balance sheet for December 31, 2015. Prepare a master budget for the first three months of 2016. Round to the nearest dollar. Prepare a mast..

|

|

What is the price elasticity of demand for iced coffee

: Two friends who are addicted to Starbuck’s iced coffee were overheard talking. John said “No matter what the price of iced coffee is or will be, I will buy 4 cups a day.” His friend, Peter said “if Starbucks raises the price of a tall iced coffee abo..

|

|

What is marginal benefit

: Your firm's research department has estimated your total revenues to be R(Q) = 600Q - 4Q2 and your total costs to be 60 + 2Q2. (Note that MB = 600 - 8Q and MC = 4Q).a. What level of Q maximized net benefits?

|

|

Advise the parties of their respective legal positions

: Advise the parties of their respective legal positions in each of the following separate circumstances: Kevin learns that he is being seconded abroad for 2 years by his employer. He now informs Brainchild that he no longer wants his villa painted. He..

|

|

During the industrial revolution

: During the industrial revolution:

|