Reference no: EM131533093

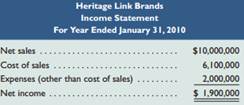

Question: Opening feature about Heritage Link Brands. Assume that Selena and Khary Cuffe report current annual sales at approximately $10 million and disclose the following income statement.

Selena and Khary Cuffe sell to various individuals and retailers, ranging from small shops to large chains. Assume that they currently offer credit terms of 1y15, ny60, and ship FOB destination. To improve their cash flow, they are considering changing credit terms to 3y10, ny30. In addition, they propose to change shipping terms to FOB shipping point. They expect that the increase in discount rate will increase net sales by 9%, but the gross margin ratio (and ratio of cost of sales divided by net sales) is expected to remain unchanged. They also expect that delivery expenses will be zero under this proposal; thus, expenses other than cost of sales are expected to increase only 6%.

Required: 1. Prepare a forecasted income statement for the year ended January 31, 2011, based on the proposal.

2. Based on the forecasted income statement alone (from your part 1 solution), do you recommend that Selena and Khary implement the new sales policies? Explain.

3. What else should Selena and Khary consider before deciding whether or not to implement the new policies? Explain.