Reference no: EM131703479

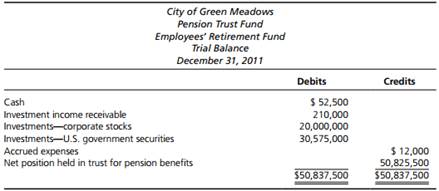

Question: (Journal entries and statements for a Pension Trust Fund) The City of Green Meadows has had an employee pension fund for several years. The following is a trial balance for the fund at December 31, 2011, as well as several transactions that occurred during 2012. Prepare

(a) the journal entries necessary to record the transactions,

(b) a statement of changes in fiduciary net position for the fund for 2012, and

(c) a statement of fiduciary net position as of December 31, 2012.

1. Contributions from the General Fund totaled $750,000; included in this amount was $258,750 from the employees and $491,250 from the city.

2. Corporate stocks costing $500,000 were purchased.

3. The fund collected interest accrued as of December 31, 2011. Investment income for 2012 totaled $4,800,000, of which $4,290,000 was collected in cash. Investment income earned in 2012 included dividends of $850,000, and the remainder was interest.

4. Employee retirement benefits of $3,500,000 were paid.

5. Additional U.S. government securities totaling $1,100,000 were acquired.

6. Costs of operating the plan were $175,000; of this amount $150,000 was paid in cash, and the remainder was accrued. The accrued expenses at the beginning of the year were also paid. These expenses were administrative in nature.

7. U.S. government securities that had a book value of $500,000 were redeemed for $600,000.

8. The market value of the corporate stocks at the end of the year increased by $1,000,000.