Reference no: EM131041382

Task

The purpose of this assignment is to continue to develop skills in costing systems. The assignment emphasizes the role of control in managing the production of goods and services efficiently in the workplace. Each question builds on the knowledge gained through the first assignment to develop the concepts of management accounting control through costing. Each question uses realistic data and the professional practices similar to that found in these workplaces.

QUESTION 1- Job costing

Create a spreadsheet solution to the following problem. Follow the template provided.

Play the Job cost podcasts and work through the example problem in those podcasts.

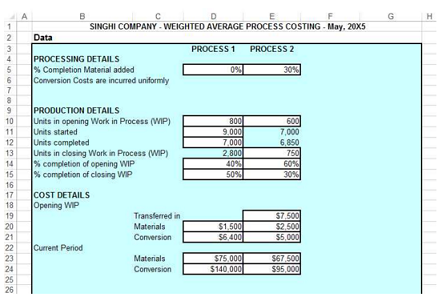

QUESTION 2- Process costing

Prepare a spreadsheet to solve the following process costing problem.

Review the four process costing videos provided in Interact Resources. Note that in the situation below there are two production departments

QUESTION 3 - Joint costing

Create a spreadsheet to solve the following joint cost problem.

Joint cost allocation: additional processing beyond split-off point

ABC Company produces three joint products: A, B and C. The material is added at the beginning of the process. At the end of Process 1, the split-off point, the three intermediate products enter three separate further processes. Product A enters Process 2, Product B enters Process 3 and Product C enters Process 4. None of the products can be sold unless the subsequent processing is carried out.

The following information relates to the month of June:

(i) Direct material issued to Process 1, $26 000.

(ii) Conversion costs incurred:

Labour Overhead

Process 1 $10 000 $14 000

Process 2 3 000 2 000

Process 3 1 000 1 000

Process 4 600 400

(iii) There was no work in process at the beginning or end of the month, and no finished goods inventories at the beginning of the month.

(iv) Details of production and sales:

|

Product |

|

A |

B |

C |

| Tonnes produced |

500 |

400 |

100 |

| Tonnes ordered |

600 |

600 |

200 |

| Tonnes delivered |

400 |

350 |

50 |

| Selling price/tonne |

$110 |

$80 |

$210 |

All delivery costs are met by customers.

Required:

(a) A statement showing the allocation of joint costs to products A, B and C using (i) a physical measures method, and (ii) the relative sales value method.

(b) Suppose that C's price falls to $7 per tonne. It costs $5 per tonne to dump material at the tip. Should Product C be dumped at the split-off point or processed further?

Question 4- Variance analysis

A. Solve using a spreadsheet. See the requirements embedded in the spreadsheet. Include the IF function to determine Favourable and Unfavourable variances.

B. Prepare a Business Report as if for senior management:

1. Critically evaluate the purpose of variance analysis,

2. Explain why the materials price variance should be calculated on purchase,

3. Identify other areas in an organisation where variance analysis would be useful and

4. Evaluate the practical relevance of detailed overhead variance analysis.

For item 4. see the reading by Murray Wells.

Suggested word limit about 300- 400 words. Ensure that your answer is in business report format. Read the following online references regarding business report writing.

https://bit.ly/FoBAcademic-Writing-Skills

and

https://unilearning.uow.edu.au/report/4b.html

Sphero Inc. Variance Analysis - Materials and Labour

Data

Standard direct-labour rate - $15.40

Actual direct-labour rate - $12.20

Standard direct-labour hours - 13,000

Direct-labour usage variance-unfavourable - $9,800

Standard unit price of materials - $5.00

Actual quantity purchased and used - 1,800

Standard quantity allowed for actual production - 1,650

Materials purchase price variance - favourable - $298

Required-

1. Compute the actual hours worked rounded to the nearest hour.

2. Compute the actual purchased price per unit of materials rounded to the nearest cent.

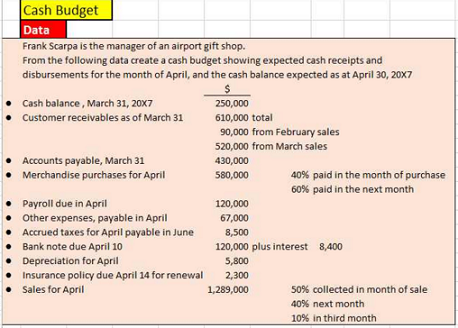

QUESTION 5- Cash budget

Prepare the cash budget for the month ending April 30, 2007.

1. Spreadsheet the cash budget

2. How much is received from March sales?

3. How much was the sales in March? February?

4. What is meant by what if questions in the context of the budgetary process? What is the purpose of asking this type of question? How are financial models used to answer them? For Scarpa, change the spreadsheet forecasts to show a negative cash balance for April. Comment. Paste the original normal view and the changed view together with one formula view.