Reference no: EM13319228

Question 1

Melissa Tang recently received an inheritance of $2 million and is now trying to decide how best to invest the funds. Following a preliminary conversation with an investment advisor, she has decided that it would probably be best to split her investments between debt and equity. However, after reading the material that the investment advisor had given her, she was confused about the tax implications of the two types of investments and has asked you to help her determine the taxes she might expect to pay on the various investments that the investment advisor has recommended.

As a first step, you have determined that her marginal federal tax rate is 29% and her marginal provincial tax rate is 16%. You have also determined that the gross up on eligible dividends is 38%, the dividend tax credit is 15.02% of the grossed-up amount, and the provincial tax rate on eligible dividends is 10.5% of the actual dividend.

One of the equity investments that the advisor has recommended is the shares of Anderson Company, which are currently selling for $12.50. Anderson has consistently declared and paid a dividend of $0.75 per share for the past ten years and the advisor has stated that they believe the dividends should remain unchanged for the foreseeable future. The advisor has also stated that they believe that the shares will be trading at a price of $15 in one year's time.

The bond investment that the advisor has recommended is the bonds of Gardner Company. The bonds are currently priced $88 for each $100 face value bond, carry a coupon rate of 6% payable semi-annually, and have 10 years remaining until maturity. Based on anticipated changes in interest rates, the advisor believes that the bonds will be selling for $95 in one year's time.

a. If the investment advisor's beliefs are realized, what is the total tax that Melissa would have to pay if she invests $1,000 in the shares of Anderson Company today and then sells them in one year's time?

b. If the investment advisor's beliefs are realized, what is the total tax that Melissa would have to pay if she purchases 10 $100 face value bonds of Gardner Company today and then sells them in one year's time?

c. If Melissa decides to invest $500,000 in the bonds of Gardner Company and $1.5 million in the shares of Anderson Company, what is the expected after-tax rate of return on her investment portfolio?

Question 2

A client of Investment Advisor Associates (IAA), Gillian Bissett, has recently won $5 million in the lottery and has asked for investment advice. She has indicated that she would like to have $5 million available for her retirement in 15 years and has therefore decided to invest $2 million in a secure account that is expected to provide an effective annual return of 4% over this period. She would then like to supplement her current income and add to the balance in the secure account by investing the remaining $3 million that she has won. Here, she has initially indicated that she would like to invest a part of the remaining amount in government bonds and the remainder in an equity fund highly recommended by IAA. As a part of their advice, she has asked IAA to provide her with details on the return and risk profiles of these two investments.

a. Assume that Gillian deposits $2 million into the secure account at 4%. How much must she additionally deposit into the account at the end of each year for the next 15 years to have the required $5 million at the end of the 15 years, assuming that she intends to deposit an equal amount each year?

b. The government bonds that Gillian is interested in investing in have a 12-year maturity and a coupon rate of 6% paid semi-annually. These bonds are currently selling at $108 for each $100 face value bond. What is the yield to maturity on these bonds? What is their expected effective annual return?

c. The equity fund recommended by IAA has provided a dividend (current) yield of 4% over the past decade as well as providing a consistent capital gain. Gillian would like to know what the required return on the equity fund is. To determine this, the following information is available:

• Expected return on the market = 10%

• Standard deviation of the market return = 12%

• Risk-free rate = 3.5%

• Standard deviation of return on the equity fund = 20%

• Correlation between the return on the equity fund and the market = 0.75

Based on this information, what is the required return on the equity fund?

d. If the standard deviation of return for the bonds in part (b) is 8% and the correlation between their return and the return on equity fund in part (c) is 0.55, what is the standard deviation of return for a portfolio comprised of 35% bonds and 65% the equity fund?

e. Estimate the beta of this portfolio (35% bonds and 65% equity) and determine its required return according to the security market line (SML) based on the information supplied in parts (b), (c), and (d) above if the correlation coefficient between the bond returns and the market returns is 0.3.

f. Ignore your answers for parts (b) and (c), and alternatively assume that the expected effective annual return on the bond is 7% and the expected return on the equity fund is 12%. Also assume portfolio weights of 60% debt and 40% equity. Does the portfolio lie above or below the SML?

g. Independent of parts (a) to (f) above, Gillian is considering investing in a relatively new company whose profitability has been growing at a compound rate of 25% per year. Using the constant growth DDM (dividend discount model), she calculates that the share price should be $75; this is substantially more than the actual market price of the shares ($50). What is the most likely reason for the wide disparity between the observed price and that which Gillian estimates?

Question 3

You have been asked by Wavejumper (WJ) Ltd., a manufacturer of windsurfers, to evaluate its capital structure. As a first step, you need to estimate WJ's current weighted average cost of capital (WACC).

You have been provided with the following information to complete this task. WJ currently has a $200 million face value long-term debt issue outstanding. The bonds have 6 years remaining until maturity, carry a 12% coupon, payable semi-annually, and are priced to yield 10%. WJ also has 10 million preferred shares outstanding. These shares have a stated par value of $25, carry a 6% dividend rate, and are currently trading at $18.75. Finally, WJ has 15 million common shares outstanding, which are currently trading at $21. WJ paid a dividend of $1.25 per share on its common shares last year and investment analysts have projected these dividends to grow at an average annual rate of 3% for the foreseeable future.

WJ has been advised by its underwriters that flotation costs would be 4% after-tax on new debt and preferred shares, and 6% before-tax on common shares. WJ's marginal tax rate is 38%.

Required

a. Determine the appropriate weights to use in determining WJ's WACC.

b. Calculate WJ's cost of debt, cost of preferred shares, cost of internal equity, and cost of issuing new common equity.

c. Based on your calculations in parts (a) and (b), estimate the firm's WACC, assuming all of the required equity can be generated internally.

d. What is the firm's marginal cost of capital (MCC) if the firm needs to issue new common shares?

Question 4

Stewiacke Ltd. is currently considering a project with a 4-year life that it believes has the potential to return the company to profitability. Having completed a market survey at the cost of $50,000, it is now ready to undertake a capital budgeting analysis of the project. The following information has been collected for the purpose of determining the project's net present value (NPV).

The project will require an initial investment of $8 million that will be split equally between a new building and new equipment. The project will also require an investment of $500,000 in additional net working capital that will be released at the conclusion of the project.

Stewiacke intends to build on a block of land that it purchased last year for $2 million. The land has a current market value of $2.5 million and independent appraisers have indicated that its value should grow at an average annual rate of 3% over the next 10 years. The equipment is estimated to have a 4-year useful life, at the end of which it is expected to have a zero salvage value. The building is estimated to have a 15-year useful life, with an expected salvage value at the end equal to 25% of its original cost. At the end of year 4, the building is expected to be worth 50% of its original cost. Both the building and equipment will be depreciated on a straight-line basis for accounting purposes.

It is estimated that the project will generate gross revenues of $6 million per year, with costs of goods sold expected to be 55% of gross revenues.

Finally, Stewiacke's marginal tax rate is 30% and its weighted average cost of capital is 10%. The applicable CCA rates on the new building and the new equipment are 15% and 7.5%, respectively.

Required

a. Estimate the initial after-tax cash outlay for the proposed project.

b. Estimate the net present value associated with the proposed project.

c. Should Stewiacke Ltd. go ahead with this project? Briefly explain.

d. Given that Stewiacke presently has 10 million common shares outstanding that are trading at $10.00 per share, what will be the new price per share if the firm accepts this project, assuming the markets are efficient?

Question 5

You have been asked to determine the EPS indifference EBIT* level for your firm using the following information. Under the high-leverage alternative (a D/E ratio of 1.50), the firm would have 50,000 common shares outstanding, its pre-tax cost of debt would be 8%, and the face value of its outstanding debt would be $750,000. Under the low-leverage alternative (a D/E ratio of 0.80), the firm would have 75,000 common shares outstanding, its after-tax cost of debt would be 4% and the face value of its outstanding debt would be $250,000. The firm's tax rate is 30%.

Required

a. Determine the firm's EPS indifference EBIT* given this information.

b. Explain what the EPS indifference EBIT* is and how it can be used to assist the firm make its capital structure choice.

c. If the firm's expected EBIT is $75,000, which capital structure alternative would you recommend?

Question 6

a. What are the potential advantages and disadvantages to a company's shareholders if the company increases the proportion of debt in its capital structure?

b. How do personal taxes affect an investor's preference for high versus low dividend yields?

Source: Adapted from Introduction to Corporate Finance, Second Edition, Booth and Cleary, 2010, John Wiley & Sons Canada, Ltd., Chapter 22, Practice Problem 14, page 906.

Reproduced with permission from John Wiley & Sons Canada, Ltd.c. There is evidence that suggests that dividends have a more stable pattern than earnings. What type of dividend policy is management adopting if it decides to pay a stable dividend in the face of fluctuating earnings, and why might they do so?

Question 7

a. After calculating an NPV of $11,911, Renew Inc. has decided to undertake a three-year project to manufacture guardrails from recycled plastic. The project requires a $150,000 machine that will be amortized over three years on a straight-line basis for accounting purposes to an estimated salvage value of $25,000 at the end of the project. Renew is now trying to decide whether to lease the machine or to purchase it.

Additional information used in the NPV calculation is as follows. The project will require an additional investment in inventory of $20,000 and is expected to generate net (before-tax) operating cash flows of $80,000, $90,000, and $100,000 in years 1 through 3, respectively.

Renew's tax rate is 36%, its weighted average cost of capital is 21%, and the applicable CCA rate on the machine is 20%.

If Renew decides to lease the machine, it will have to make annual lease payments of $40,000 per year at the beginning of the year.

Determine whether Renew should lease or purchase the machine if its before-tax cost of borrowing is 8%.

b. Briefly describe three motivations for leasing.

Question 8

a. Explain the relationship between NPV and a firm's value. Why might the relationship not behave as expected?

b. Explain why NPV is generally preferred over IRR when choosing among competing (mutually exclusive) projects.

Question 9

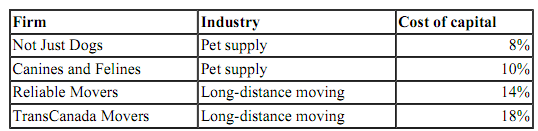

BMP Consulting (BMPC) conducted an analysis of Delta Corp. and found that the firm consists of two different divisions: Pet Lovers, a pet supply retail outlet, and Able Move, a long-distance moving company. Delta is currently considering a project related to pet supplies and has asked for BMPC's assistance with the analysis. As a part of its response, BMPC examined firms that operate within the industries of each of Delta's two divisions, finding the following:

a. When is it appropriate to use the firm's weighted average cost of capital (WACC) to evaluate a proposed investment?

b. Based on this information, what is a reasonable discount rate for BMPC to use in its assessment of the proposed pet supply project? Describe any assumptions that you make in arriving at this discount rate.

c. What would be the potential implications for Delta if WACC is used to evaluate the pet supply project?

Source: Adapted from Introduction to Corporate Finance, Second Edition, Booth and Cleary, 2010, John Wiley & Sons Canada, Ltd., Chapter 13, Practice Problem 22, page 547. Reproduced with permission from John Wiley & Sons Canada, Ltd.

Question 10

a. Explain the importance of market efficiency for the assumed objective of maximizing shareholder wealth.

b. In the past, you have successfully used the following simple trading rule to buy and sell shares: if the stock has risen for the last three days - sell; if the stock has fallen for the last three days - buy. Explain whether or not this is an example of informational efficiency.

c. If a security has a beta greater than 1 but offers an expected return that is less than the expected return on the market portfolio, does the security plot above or below the security market line (SML)?