Reference no: EM131533757

Question: Refer to the information in Exercise 9-6 to complete the following requirements.

a. Estimate the balance of the Allowance for Doubtful Accounts assuming the company uses 3.5% of total accounts receivable to estimate uncollectibles, instead of the aging of receivables method.

b. Prepare the adjusting entry to record Bad Debts Expense using the estimate from part a. Assume the unadjusted balance in the Allowance for Doubtful Accounts is a $300 credit.

c. Prepare the adjusting entry to record Bad Debts Expense using the estimate from part a. Assume the unadjusted balance in the Allowance for Doubtful Accounts is a $200 debit.

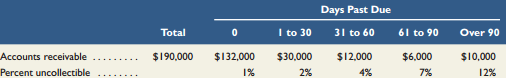

Exercise: Hecter Company estimates uncollectible accounts using the allowance method at December 31. It prepared the following aging of receivables analysis.

a. Estimate the balance of the Allowance for Doubtful Accounts using the aging of accounts receivable method.

b. Prepare the adjusting entry to record Bad Debts Expense using the estimate from part a. Assume the unadjusted balance in the Allowance for Doubtful Accounts is a $600 credit.

c. Prepare the adjusting entry to record Bad Debts Expense using the estimate from part a. Assume the unadjusted balance in the Allowance for Doubtful Accounts is a $400 debit.