Reference no: EM13203751

1) An investor bought 100 shares of omega common stock for $9000. He held the stock for 9 years. For the first 4 years he receives annual end-of year dividends of $800. For the next 4 years he received annual dividends of $400. He received no dividend for the 9th year. At the end of 9th year he sold his stock for $6000. What rate of return did he receive on his investment?

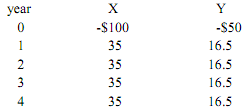

2) Consider two mutually exclusive alternatives:

If the MARR is 10%, which alternative should be selected? (Incremental analysis required).

3) The manager of a large food processing corporation is trying to decide between two alternative designs for an oil press. The first alternative costs $250,000 and has a first-year operating cost of $45,000. Operating costs are estimated to increase by $5000 per year for each year after the first. The projected life time of this design is 8 years and there is no salvage value.

The second alternative costs $375,000 and has a first year operating cost of $15,000. The operating costs are estimated to increase at a rate of $7000 per year. The projected life time of design 2 is 10 years. There is no salvage value. The benefits of each design are identical and the plant will be in operation for a long time. Assuming an 8% interest rate which design should be chosen?

4) A new project has the following predicted profits. The initial investment is $3,000,000.

Year Revenue

1 $200,000

2 $400,000

3 $600,000

4 $800,000

5 $1,200,000

6 $1,200,000

7 $1,400,000

8 $1,600,000

a) Determine the Rate of Return for the project.

b) If your company's MARR is 12%, should you invest?

5) You have been assigned to determine the RoR for a large, capital intensive project. The following cash flows have been predicted by the folks in marketing.

Year Revenue

0 $150 million

1 $100 million

2 $-450 million

3 $-450 million

4 $250 million

5 $550 million

When you plug these numbers into a solver, two RoRs are revealed, 45.3% and 21.0%. Knowing that your company's einv = 15% and efin = 7.5%, what RoR do you report to your manager?

|

What is the value of the positive root in auxiliary equation

: To two decimal places, what is the value of the positive root in the auxiliary equation?

|

|

Find what are the dimensions of the picture

: The frame around the picture has a uniform width of 2 inches and an area of 96 square inches. What are the dimensions of the picture?

|

|

State reflection are said to be translation congruent

: Figures that correspond under a translation, rotation, or reflection are said to be translation congruent, rotation congruent, or reflection congruent. Position two congruent figures on a piece of paper to satisfy

|

|

How many adult tickets did she sell

: Mariella is selling raffle tickets for a school fundraiser. Adult tickets cost $4 and student tickets cost $3. If she has collected %165 so far, how many adult tickets did she sell?

|

|

Evaluate the rate of return for the project

: Determine the Rate of Return for the project and The projected life time of this design is 8 years and there is no salvage value.

|

|

Use differentials to estimate the maximum error

: The dimensions of a closed rectangular box are measured as 86 cm, 69 cm, and 23 cm, respectively, with a possible error of 0.2 cm in each dimension. Use differentials to estimate the maximum error in calculating the surface area of the box.

|

|

Find the length of the suspended cable

: Electrical wires suspended between two towers form a catenary modeled by the equation y= 20 cosh x/20 where x and y are measured in meters. The towers are 40 meters apart. Find the length of the suspended cable.

|

|

Find the radius of the cone that will result in a surface

: A conical paper cup is to have a height of 15 inches. Find the radius of the cone that will result in a surface area of .

|

|

Find the time required for an investment

: Find the time required for an investment of 5000 dollars to grow to 7100 dollars at an interest rate of 7.5 percent per year, compounded quarterly.

|