Reference no: EM131536706

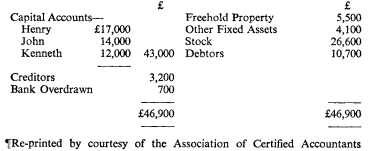

Question: Up to 31st March, 1959, Henry, John and Kenneth had been trading in partnership and sharing profits in the respective proportions of 8, 7 and 5, and the firms balance sheet drawn up as on that date was as follows:

Henry having given notice that he wished to retire on the date mentioned, and it having been determined to admit Lambert as a new partner on the following day, the following terms were agreed:

(a) The balance sheet was to be revised, before the change, by writing up the book value of the freehold property to £7,500, and £200 was to be set aside as a provision against doubtful debts.

(b) Henry was to be credited with £3,000 for his share of Goodwill. He was to be paid £5,000 out of money to be brought in by Lambert, and agreed to leave the balance of the sum remaining due to him as a loan to the firm.

(c) Lambert was to bring in £7,000 in cash and to be entitled to one-fifth of the profits, the other partners, as between themselves, sharing the balance in the same proportion as before.

(d) Finally, adjustments were to be made between the partners; capital accounts to give effect to their agreement that Lambert should purchase one-fifth of the firm's Goodwill, which was to be valued for this purpose at £9,000. No Goodwill account was to appear in the books of the new firm. Write up the partners; capital accounts, showing the entries recording the foregoing, and draw up an initial balance sheet for the new firm.

|

Prepare revaluation account and balance sheet of new firm

: PC and Y are equal partners. On 1st July, 1962, they agree to admit ? as partner. ? is to pay £2,000 as a premium-the money to be left in the business.

|

|

Principles of macroeconomics

: Principles of Macroeconomics, Ch. 6: Supply, Demand, and Government Policies

|

|

Supply-demand and government policies

: Consider what mechanisms allocate resources when the price of a good is not allowed to bring supply and demand into equilibrium.

|

|

What would be the advantages of investigating the research

: What would be the advantages and/or disadvantages of investigating this research question from either a strictly quantitative or qualitative perspective?

|

|

Draw up an initial balance sheet for the new firm

: Up to 31st March, 1959, Henry, John and Kenneth had been trading in partnership and sharing profits in the respective proportions of 8, 7 and 5, and the firm.

|

|

Irrelevant in the short run anyway

: Suppose demand is given by (Q = 1100 - 300P) and MC=2. Ignore any fixed costs (irrelevant in the short run anyway) and calculate price, quantity and profit.

|

|

Developing a cyber security strategy

: Describe the role of planning when developing a cyber security strategy and what key deliverables would ensure an effective implementation and transition

|

|

Vehicle for enhancing entrepreneurship

: Business plan competitions are becoming more popular as a vehicle for enhancing entrepreneurship.

|

|

What recommendations would you have for ceo doug and ivester

: Scenario 1: A European Crisis for Coca Cola- Leaders are symbolic representatives. What recommendations would you have for the CEO, Doug Ivester?

|