Reference no: EM131665802

Question: Strategic analysis of operating income. Refer to Exercise.

1. Calculate Gianni‘s operating income in both 2016 and 2017.

2. Calculate the growth, price-recovery, and productivity components that explain the change in operating income from 2016 to 2017.

3. Comment on your answers in requirement 2. What does each of these components indicate?

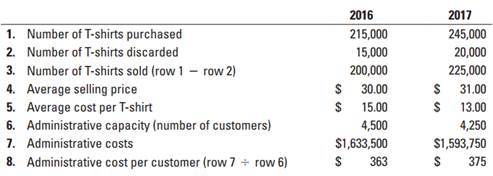

Exercise: Strategy, balanced scorecard, merchandising operation. Gianni & Sons buys T-shirts in bulk, applies its own trendsetting silk-screen designs, and then sells the T-shirts to a number of retailers. Gianni wants to be known for its trendsetting designs, and it wants every teenager to be seen in a distinctive Gianni T-shirt. Gianni presents the following data for its first two years of operations, 2016 and 2017.

Administrative costs depend on the number of customers Gianni has created capacity to support, not on the actual number of customers served. Gianni had 3,600 customers in 2016 and 3,500 customers in 2017.

1. Is Gianni's strategy one of product differentiation or cost leadership? Explain briefly.

2. Describe briefly the key measures Gianni should include in its balanced scorecard and the reasons for doing so.