Reference no: EM131821912

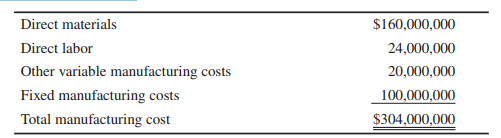

Question: Production-Volume Variance at L.A. Darling Company Review the Chapter 12 opening vignette on L.A. Darling Company (page 507 ). L.A. Darling receives about $6 billion of revenue each year from designing, manufacturing, and installing store fixtures in retail stores. Accounting for fixed manufacturing overhead is a challenge for the company. Suppose a manufacturing division of the company has the following budgeted costs for production of 800,000 shelving units in 2012:

During 2012, this division of L.A. Darling produced 850,000 of the shelving units and sold 820,000 of them for $450 million. Assume that L.A. Darling does not allocate selling or administrative costs to the individual products.

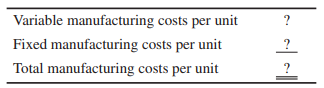

1. Compute the following budgeted unit costs for 2012:

2. Compute the production-volume variance for 2012. Be sure to label it favorable or unfavorable.

3. Compute the 2012 profit from the production and sales of the shelving using absorption costing. Ignore selling and administrative costs.

4. Compute the 2012 profit from the production and sales of the shelving using variable costing. Ignore selling and administrative costs.

5. Which measure of profit, absorption-costing profit or variable-costing profit, is a better measure of performance during 2012? Explain.