Reference no: EM131823228

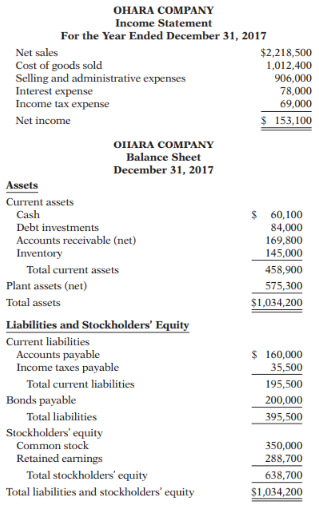

Question: The following are financial statements of Ohara Company.

Additional information: The net cash provided by operating activities for 2017 was $190,800. The cash used for capital expenditures was $92,000. The cash used for dividends was $31,000. The weighted-average number of shares outstanding during the year was 50,000.

Instructions: (a) Compute the following values and ratios for 2017. (We provide the results from 2016 for comparative purposes.)

(i) Working capital. (2016: $160,500)

(ii) Current ratio. (2016: 1.65:1)

(iii) Free cash flow. (2016: $48,700)

(iv) Debt to assets ratio. (2016: 31%)

(v) Earnings per share. (2016: $3.15)

(b) Using your calculations from part (a), discuss changes from 2016 in liquidity, solvency, and profitability.

|

How specialization and exchange can create more output

: In this chapter, we've often emphasized how specialization and exchange can create more output. But sometimes the output from voluntary exchange is difficult.

|

|

How much did national output fall during great depression

: How much did national output fall during the Great Depression? According to the chapter, which government agency might have helped to avoid much.

|

|

Discuss about the economic booms and busts

: When bad weather in India destroys the crop, does this sound like a fall in the total "supply" of crops or a fall in people's "demand" for crops?

|

|

What was the company earnings per share for each year

: Suppose the following information is available for Callaway Golf Company for the years 2017 and 2016. (Dollars are in thousands, except share information.)

|

|

Compute the given values and ratios for particular year

: Additional information: The net cash provided by operating activities for 2017 was $190,800. The cash used for capital expenditures was $92,000.

|

|

Compute the current ratio and debt to assets ratio

: Compute earnings per share for 2017 and 2016 for Nguoi, and comment on the change. Nguoi's primary competitor, Matisse Corporation, had earnings per share.

|

|

Compute the current ratio and debt to assets ratio

: Compute earnings per share for 2017 and 2016 for Nguoi, and comment on the change. Nguoi's primary competitor, Matisse Corporation, had earnings per share.

|

|

Listing the current assets in order of the liquidity

: Suppose the following items were taken from the December 31, 2017, assets section of the Boeing Company balance sheet.

|

|

Prepare the assets section of a classified balance sheet

: Prepare the assets section of a classified balance sheet, listing the items in proper sequence and including a statement heading.

|