Reference no: EM13116389

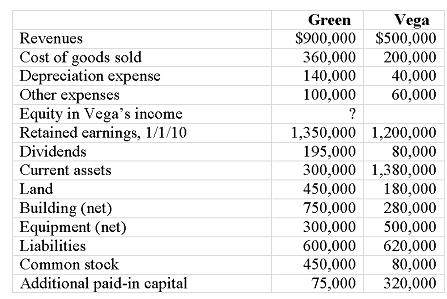

Following are selected accounts for Green Corporation and Vega Company as of December 31, 2010. Several of Green's accounts have been omitted.

Green obtained 100% of Vega on January 1, 2006, by issuing 10,500 shares of its $10 par value common stock with a fair value of $95 per share. On January 1, 2006, Vega's land was undervalued by $40,000, its buildings were overvalued by $30,000 and equipment was undervalued by $80,000. The buildings have a 20-year life and the equipment has a 10-year life. $50,000 was attributed to an unrecorded trademark with a 16-year remaining life. There was no goodwill associated with this investment.

5. Compute the book value of Vega at January 1, 2006.

A. $997,500

B. $857,500

C. $1,200,000

D. $1,600,000

E. $827,500

6. Compute the December 31, 2010, consolidated revenues.

A. $1,400,000

B. $800,000

C. $500,000

D. $1,590,375

E. $1,390,375

7. Compute the December 31, 2010, consolidated total expenses.

A. $620,000

B. $280,000

C. $900,000

D. $909,625

E. $299,625

8. Compute the December 31, 2010, consolidated buildings.

A. $1,037,500

B. $1,007,500

C. $1,000,000

D. $1,022,500

E. $1,012,500

9. Compute the December 31, 2010, consolidated equipment.

A. $800,000

B. $808,000

C. $840,000

D. $760,000

E. $848,000

10. Compute the December 31, 2010, consolidated land.

A. $220,000

B. $180,000

C. $670,000

D. $630,000

E. $450,000

Difficulty: Medium

11. Compute the December 31, 2010, consolidated trademark.

A. $50,000

B. $46,875

C. $0

D. $34,375

E. $37,500

12. Compute the December 31, 2010, consolidated common stock.

A. $450,000

B. $530,000

C. $555,000

D. $635,000

E. $525,000

13. Compute the December 31, 2010, consolidated additional paid-in capital.

A. $210,000

B. $75,000

C. $1,102,500

D. $942,500

E. $525,000

14. Compute the December 31, 2010 consolidated retained earnings.

A. $1,645,375

B. $1,350,000

C. $1,565,375

D. $2,845,375

E. $1,265,375

15. Compute the equity in Vega's income reported by Green for 2010.

A. $500,000

B. $300,000

C. $190,375

D. $200,000

E. $290,375