Reference no: EM131534323

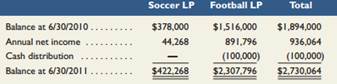

Question: Hunt Sports Enterprises LP is organized as a limited partnership consisting of two individual partners: Soccer LP and Football LP. Both partners separately operate a minor league soccer team and a semipro football team. Compute partner return on equity for each limited partnership (and the total) for the year ended June 30, 2011, using the following selected data on partner capital balances from Hunt Sports Enterprises LP.

Kim Ries, Tere Bax, and Josh Thomas invested $40,000, $56,000, and $64,000, respectively, in a partnership. During its first calendar year, the firm earned $124,500. Required Prepare the entry to close the firm's Income Summary account as of its December 31 year-end and to allocate the $124,500 net income to the partners under each of the following separate assumptions: The partners

(1) have no agreement on the method of sharing income and loss;

(2) agreed to share income and loss in the ratio of their beginning capital investments; and

(3) agreed to share income and loss by providing annual salary allowances of $33,000 to Ries, $28,000 to Bax, and $40,000 to Thomas; granting 10% interest on the partners' beginning capital investments; and sharing the remainder equally.