Reference no: EM132091244

Question: Evaluating the Effects of Three Inventory Methods on Income from Operations, Income Taxes, and Net Income (Perpetual Inventory) Courtney Company uses a perpetual inventory system. Data for 2009: beginning merchandise inventory (December 31, 2008), 1,000 units at $35; purchases include 2,000 units at $38 on March 22 and 3,000 units at $40 on July 1; operating expenses (excluding income taxes), $71,000; sales for the year include 1,500 units sold on April 14 and 3,500 sold on September 30; sales price per unit, $70; and income tax expense is 30 percent of income from operations.

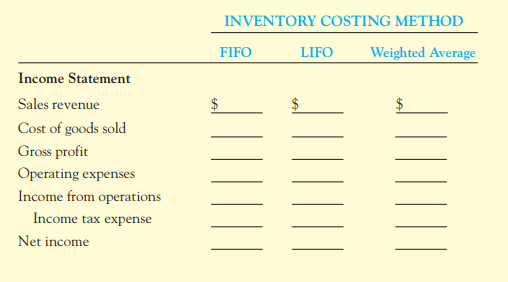

Required: 1. Compute cost of goods sold under the FIFO, LIFO, and weighted average costing methods using a format (Round weighted average cost per unit to the nearest tenth of a cent; three decimal places.) Then prepare income statements for each method using a format similar to the following:

2. Between FIFO and LIFO, which method is preferable in terms of ( a) maximizing operating income or ( b) minimizing income taxes? Explain.

3. What would be your answer to requirement 2 if costs were falling? Explain.

|

How much will the common stockholders receive

: Assuming that $150,000 will be distributed as a dividend in the current year, how much will the common stockholders receive

|

|

Determine the interaction of the atmosphere

: Data Analytics - determine the structure of the sub-surface to a depth of a few kilometres - determine the effect of the atmosphere on the surface

|

|

What is the amount of dividends received

: The board of directors declares and pays a $45,000 dividend in 2010 and in 2011. What is the amount of dividends received by the common stockholders

|

|

How are they similar and how are they different

: The connection between PR and the promotional aspect of the marketing mix (advertising, publicity, public relations)?

|

|

Compute cost of goods sold under the fifo

: Evaluating the Effects of Three Inventory Methods on Income from Operations, Income Taxes, and Net Income (Perpetual Inventory) Courtney Company.

|

|

Determine the total cost per unit of primary processes

: From these unit costs, determine the total cost per unit of primary processes and the total cost per unit of support services

|

|

Calculate income tax expense under each method

: Evaluating the Effects of Three Inventory Methods on Income from Operations, Income Taxes, and Net Income (Perpetual Inventory)

|

|

How you would determine the appropriate measurements

: How you would determine the appropriate measurements and strategic drivers to assess annually?

|

|

Identify techniques that were used to classify the country

: Explain at least three factors that would lead an investor to invest in the country you selected as an emerging market.

|