Reference no: EM13834665

Instructions:

> Using the information provided, complete a Federal Income Tax Return for tax year 2014. You are not required to prepare a state tax return. Use the 2014 tax year amounts for the standard deduction (BSD and ASD, if applicable) and exemptions. Because tax law may change until the filing season begins, the IRS will not release the 2015 tax forms until late 2015 or early 2016, in some cases.

> You may complete the tax return by hand or by using 2014 tax year tax software.

> You may choose to work in a group of up to 3 people. Other than working with your group members, you should not be comparing answers with other students (giving help or receiving help). This is considered a violation of the Student Conduct Code and will be handled accordingly. If you choose to work in a group, I will only need one tax return with all the group members' names listed at the top. (Remember that the third tax return will be prepared during class, as listed on the syllabus, similar to an exam format. For the third tax return, you will not be permitted to work in groups).

> Even though you may use tax software to prepare the tax return, it is your responsibility to check the accuracy of the tax return. I recommend doing the tax return by hand and then entering it in the tax software to see if both agree. It is a wonderful learning process when you realize they don't agree and figure out which one is correct. Be sure to go through the tax return, line-by-line, and do the calculations by hand. It is your responsibility to make sure you agree with the amounts and the location of the amounts on the tax forms and schedules.

> Refer to the form instructions provided on the IRS website for guidance. (Go to www.irs.gov and to the left-side of the screen, you will see an orange link for "Forms & Pubs". This link provides all the tax forms and instructions). The form instructions are a valuable resource. As mentioned in class, to verify the computation of tax, you will need to use the tax tables found in the Form 1040 instructions. The tax tables are located on pages 76-87 of the Form 1040 instructions.

> Your tax return must include all required IRS schedules and forms. Points will be deducted if all required schedules and/or forms are not submitted. In addition, do not submit any extra forms, schedules, or worksheets that are not required. If you would not mail the worksheet, schedule, or instructions to the IRS, I do not want it. Pretend that I am the IRS. Do not give me anything that is not required. Points will be deducted for submitting items that are not required.

> Make sure all forms and schedules used are for the 2014 tax year.

> The tax return will be graded for complete accuracy.

"Assume you are preparing & filing your client's 2014 tax return before the IRS due date of April 15, 2015.•

February 11, 2015

Dear Tax Professional,

Thank you for agreeing to prepare my Federal Income Tax Return for tax year 2014. You have come highly recommended by your former Georgia Southern University tax professor. She said you were the top student in her class/

I don't really keep up with tax law, so I am not sure exactly what you may need. 7 will just give you all the details of my year and you can use what is relevant.

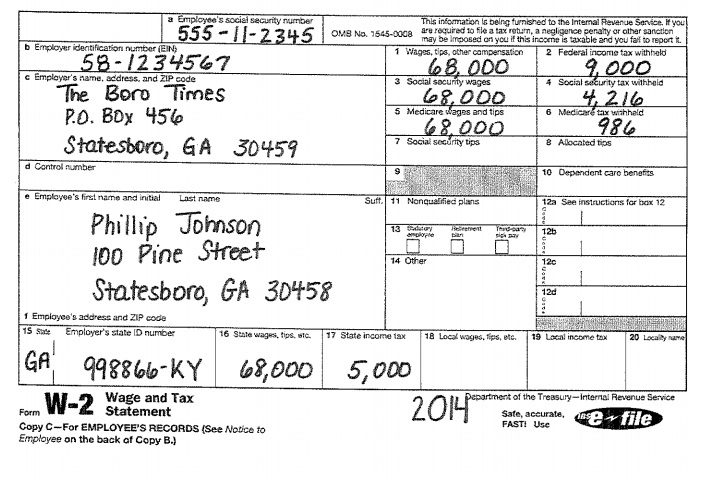

• My date of birth is June 25, 1965. My address and social security number are provided to you on my enclosed W-2. 1 am a reporter of the local newspaper, The Born Times.

• I paid student loan interest totaling $300 during 2014 to Great Lakes Education Finance. Great Lakes reported this amount to me on a Form 1098-E, with the amount in box 1.

• My wife, Janet Johnson, passed away on August 10, 2008. I have not remarried since her death. This was my second marriage.

• During 2014, 1 earned interest income of $2,950 from Bonk of America on a savings account. This amount was reported to me on a Form 1099-INT, with the amount in box 1.

• My first marriage ended quickly in a divorce. We did not have any children together. I pay my ex-wife from my first marriage alimony of $300 every month during 2014. Her name is Shay Johnson and her social security number Is 222-33-4444.

• My sister won $50,000 dollars In the lottery during 2014. Since I am her favorite brother, she gave me a gift of $5,000.

• My mother, Sue Johnson, lives with me and 7 provide over half of her support. The only income she had during 2014 was $5,000 from City of Savannah bonds. Her date of birth is January 7, 1941 and her social security number is 123¬65-4780.

• I also have two daughters who live with me, Marie and Sidney. I provide over half of their support. Marie Johnson's social security number Is 124-56-7890 and her date of birth is September 1Z 1991. Sidney Johnson's social security number is 132-45-8899 and her date of birth is April 29, 1992. During 2014, Marie was a full-time student at Georgia Southern University and earned $5,350 from a part-time job. Marie received a scholarship that covered her tuition, fees, and books, so I did not have any out of pocket expenses related to her education. Sidney wants to 'Mind herself" before she enrolls in any sort of higher education. During 2014, she earned $4,550 by working port-time. With the rest of her free time, she likes to play video games and paint.

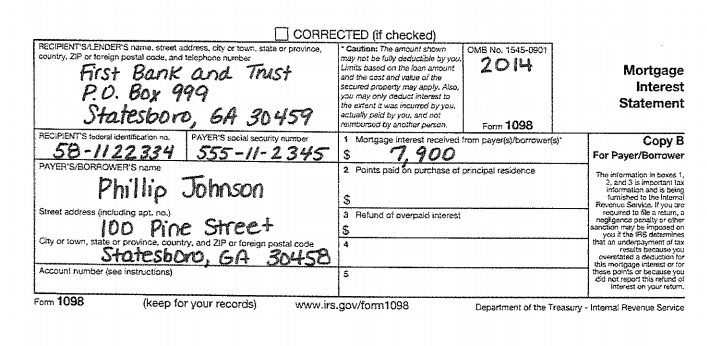

• I have a mortgage on my home with Statesboro Bank & Trust. I received a Form 1098 from my mortgage company showing the mortgage interest paid during 2014 on my personal residence. The form Is attached.

• 1 paid my annual real estate tax on my personal residence during 2014 of $2,650.

• My company does not offer a retirement plan, so I contributed a total of $5,000 to a traditional IRA during 2014.

• In addition, lam a sole-proprietor. I hove a small side business where I tutor college students. The name of my business Is Johnson Tutoring and l use the cash basis of accounting. I just started this business in 2014. I help journalism majors edit papers and offer constructive criticism. Since the business just started this year, my total revenue was only $5,800. I paid the following expenses: $1,600 for advertising, $100 for postage, and $3,800 for supplies.

• My uncle passed away and named me as beneficiary to his lee insurance policy. I received $50,000 as lee insurance proceeds.

• I paid ad valorem tax of $450 on my 2010 Chevrolet Silvered° truck

• I did not have to pay any out-of-pocket medical expenses for 2014. My dependents and I all have health Insurance coverage for the entire year, but It was paid by my employer. (Hint: The purpose of this Is related to the Affordable Care Act also known as 'Oboma Care". Certain taxpayers will be penalized if they do not hove health insurance coverage. This penalty would be shown on line 61 of Form 1040. Your client has health insurance coverage, so there should not be any penalty and you should check the box on line 61 that verifies you have full-year coverage).

I hope this Is all the information you need. My W-2 and Form 1098 are attached. If you have any questions, feel free to call me at 912-478-0404. lam hoping for o big refund! if I do get a refund, I want o check mailed to me, not direct deposited.

Sincerely,

Phillip Johnson