Reference no: EM131522167

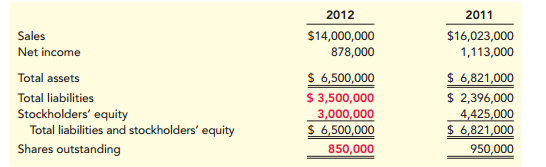

Question: Renegade Clothing is struggling to meet analysts' forecasts. It's early December 2012, and the year-end projections are in. Listed below are the projections for the year ended 2012 and the comparable actual amounts for 2011.

Analysts forecast earnings per share for 2012 to be $0.95 per share. It looks like earnings per share will fall short of expectations in 2012. Ronald Outlaw, the director of marketing, has a creative idea to improve earnings per share and the return on equity for 2012. He proposes the company borrow additional funds and use the proceeds to repurchase some of its own stock-treasury shares. Is this a good idea?

Required: 1. Calculate the projected earnings per share and return on equity for 2012 before any repurchase of stock.

Now assume Renegade Clothing purchases 100,000 shares of its own stock at $10 per share. The projections for 2012 will change as follows:

2. Calculate the new projected earnings per share and return on equity for 2012, assuming the company goes through with the treasury stock repurchase. (In computing earnings per share, average shares outstanding is now 900,000 = (850,000 + 950,000) ÷ 2.)

3. Explain how the repurchase of treasury stock near year-end improves earnings per share and the return on equity ratio.