Reference no: EM131003296

Question 1:

(a) Check the Q1a tab in the Excel spreadsheet that provides the summary statistics of 84 regressions based on cross-sectional data for each month between January 2001 and December 2007. The following summary statistics are shown in the spreadsheet:

• multipleR

• R-square

• adjusted R-square

• standard errora

• significance of F.

Define each of the above terms and interpret each of the statistics in regards to the data over the time period from January 2001 to December 2007.

(b) (i) Consider the following notations:

Ri = return of stock i for a particular month

Xi1 = exposure of stock i to the constant unit of 1

Xi2 = exposure of stock i to the size

Xi3 = exposure of stock i to the momentum

Xi4 = exposure of stock i to the value

f1 = the intercept term

f2 = the regression coefficient of size

f3 = the regression coefficient of momentum

f4 = the regression coefficient of value.

Complete the formula for the specific returns (or residual term) of stock i for a particular month,Ui, given the information above and the linear regression model. What do the specific returns attempt to measure?

(ii) Calculate the monthly specific returns (i.e. the residuals of the regressions) for CBA, WES and BHP for the 84-month in-sample period. To do this calculation, use the formula derived from part (i), the data given in the notations in part (i), and the data in the ‘Q6b' tab of the Excel spreadsheet.

From your Excel results, paste a copy of the specific returns for CBA, WES and BHP forthe months of January 2001 and December 2007onlyin the Word document of your assignment (and in the format below).

|

Month

|

CBA

|

WES

|

BHP

|

|

Jan. 2001

|

|

|

|

|

Dec. 2007

|

|

|

|

(c) Calculate the historical variance of the monthly specific returns for CBA, WES and BHP for the 84 month in-sample period.

Note: The specific returns are assumed to be uncorrelated so that the off-diagonal elements of the covariance matrix are zero.

From your Excel results, paste a copy of the monthly specific returns covariance matrix for CBA, WES and BHP in the Word document of your assignment (and in the format below).

|

|

Monthly specific returns covariance matrix

|

|

|

CBA

|

WES

|

BHP

|

|

CBA

|

|

|

|

|

WES

|

|

|

|

|

BHP

|

|

|

|

See the ‘Q1c-d' tab of the Excel spreadsheet.

(d) From your Excel results, paste a copy of the annualised specific returns volatilities for CBA, WES and BHP in the Word document of your assignment (and in the format below). See the ‘Q1c-d' tab of the Excel spreadsheet.

|

|

Annualised specific returns volatility

|

|

|

CBA

|

WES

|

BHP

|

|

CBA

|

|

|

|

|

WES

|

|

|

|

|

BHP

|

|

|

|

Question 2:

Answer the questions below, providing reasons and valid arguments to demonstrate your understanding of regression limitations and how to manage them in practice.

(a) Describe the four (4) conditions that must be satisfied for a regression analysis to be valid.

(b) Describe two (2) ways of dealing with heteroscedasticity.

(c) Calculate the rolling 12-month volatility of price returns for each of the 10 stocks over the in sample period using data in the ‘Q7' tab in the Excel spreadsheet.

Note:The rolling 12-month volatility at any month is the annualised standard deviation using the monthly returns of the preceding 12 months.

Save your Excel workings for part (c) as a tab labelled ‘2c'.

(d) Draw a graph of the results in part (c).Based on the graph, describe the relationship between volatilities of stocks over time.

(e) Explain the Durbin-Watson test and how its results should be interpreted.

(f) Why would a transformation of the dependent variable be used?

Describe what sorts of transformations are commonly used.

(g) Explain four (4) steps in a backward elimination stepwise regression approach.

Question 3

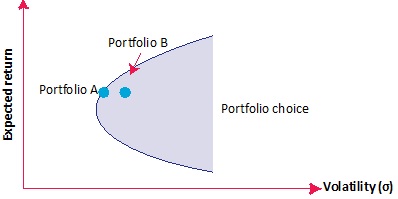

Use Figure 1 to answer the questions below.

Figure 1

(a) (i) What does Figure 1 depict and what is the financial name or description given tothediagram?

(ii) Which portfolio (A or B) would be preferred and why?

(b) Explain how volatility is measured with respect to Figure 1.

(c) (i) A portfolio manager decides to allocate superannuation funds of their recent clients who are more risk averse than average. What would the portfolio manager need to do to achieve this outcome?

(ii) Briefly state where this portfolio of assets would be represented with respect to Figure 1.

Question 4:

Assume that we have estimated the following AR(1) model:

Xt = 0.0825 + 0.7654Xt - 1 + et

Furthermore, assume that the current level of X is 0.4968.

(a) Forecast the value of X at time 1 (X1) and time 4 (X4).

(b) Which of these two forecasts is likely to be more reliable? Why?

(c) What is serial correlation? How do we test for its presence in this model?

(d) What is the mean reverting level of this model? What does this mean?

Attachment:- FIN201.xlsx