Reference no: EM131113892

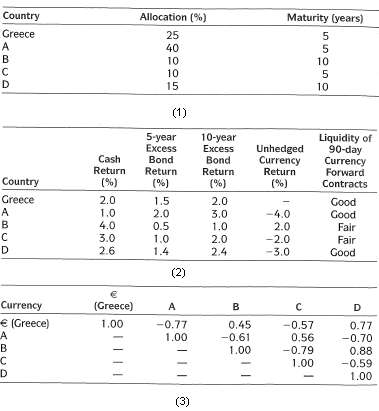

The Glover Scholastic Aid Foundation has received a €20 million global government bond portfolio from a Greek donor. This bond portfolio will be held in euros and managed separately from Glover's existing U.S. dollar-denominated assets. Although the bond portfolio is currently unhedged, the portfolio manager, Raine Sofia, is investigating various alternatives to hedge the currency risk of the portfolio. The bond portfolio's current allocation and the relevant country performance data are given in Exhibits 1 and 2. Historical correlations for the currencies being considered by Sofia are given in Exhibit 3. Sofia expects that future returns and correlations will be approximately' equal to those given in Exhibits 2 and 3.�

a. Calculate the expected total annual return (euro-based) of the current bond portfolio if Sofia decides to leave the currency risk unhedged. Show your calculations.

b. Explain, with respect to currency exposure and forward rates, the circumstance in which Sofia should use a currency forward contact to hedge the current bond portfolio's exposure to a given currency.

c. Determine which one of the currencies being considered by Sofia should be the best proxy hedge for Country B bonds. Justify your response with two reasons. Sofia has been disappointed with the low returns on the current bond portfolio relative to the benchmark-a diversified global bond index-and is exploring general strategies to generate excess returns on the portfolio. She has already researched two such strategies: duration management and investing in markets outside the benchmark index.

d. Identify three general strategies (other than duration management and investing in markets outside the benchmark index) that Sofia could use to generate excess returns on the current bond portfolio. Give, for each of the three strategies, a potential benefit specific to the current bondportfolio.

|

Identify peripheral- central route persuasion in advertising

: Briefly describe the magazine or newspaper advertisement you found where you used the peripheral route to persuasion. Identify the factors that reduce your motivation and/or ability to process the content of the advertisement. Describe a source cu..

|

|

Safety net for economic downturns

: The Helium Corp has just decided to save $10,000 each quarter for the five years as a safety net for economic downturns. The money will be set aside in a separate savings account that pays 6.25 percent annual rate, with interest compounded quarte..

|

|

Explain differences between due process and crime control

: Explain the differences between Due Process and Crime Control. What groups may value one over the other? Is one more effective than the other - why or why not

|

|

Purchase the proceeds from the lottery

: Chris Marlowe just won the state lottery which promises to pay him $1,500 per year for 20 years, starting from today, and $1,850 per year for years 21-45, given a 6.75% discount rate. Your company wants to purchase the proceeds from the lottery f..

|

|

Calculate the expected total annual return

: Calculate the expected total annual return (euro-based) of the current bond portfolio if Sofia decides to leave the currency risk unhedged. Show your calculations. Explain, with respect to currency exposure and forward rates, the circumstance in whic..

|

|

Determine the resultant line current and power factor

: Determine the resultant line current and power factor.

|

|

Exemplary programs operated by correctional systems

: Select a program area that you would like to explore to determine the best practices or exemplary programs operated by correctional systems

|

|

Explain the need for local law enforcement

: Explain the need for local law enforcement to monitor such world events. Give examples of how monitoring can be accomplished or compile a list of waysto formally monitor world events

|

|

Reasons that entrepreneurs may not actually obtain

: What are some of the reasons that entrepreneurs may not actually obtain debt financing, though they might very much need it?

|