Reference no: EM131102604

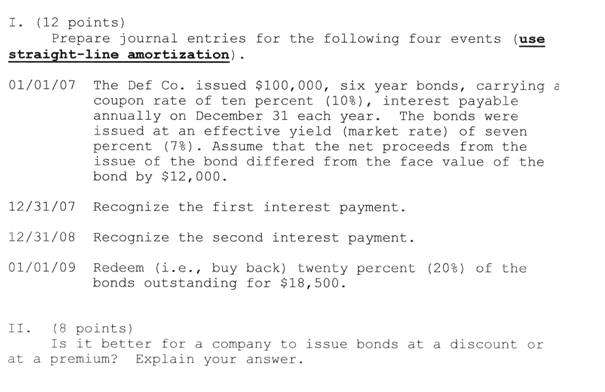

II/. Prepare journal entries for ABC Co.'s following events.

05/12/08 Received charter authorizing ABC Co. to issue 20,000 shares of common stock at a par value of $2 per share.

06/03/08 Issued 8,000 shares of stock, receiving $40,000.

06/04/08 Paid the law firm of Lo, Ball and Hyde for their services to help organize the company by sending them two thousand shares of stock.

11/15/08 Declared a cash dividend of $2 per share, payable on 01/15/09, to holders of record as of 12/15/08.

12/15/08 Make the appropriate entry.

12/31/08 Make any necessary adjusting entry.

01/15/09 Make the appropriate entry.

06/12/09 Declared a ten percent (10%) stock dividend, payable on 7/15/09 (ignore the date of record for this event). The market value of the stock is $15 per share.

07/15/09 Make the appropriate entry.

08/15/09 Declared a two-for-one stock split. The market value of the stock is $15 per share.

09/15/09 Declared and paid a cash dividend of S2 per share (pretend this happens all in one day).

10/01/09 Purchased 1,000 shares of treasury stock for a total price of $30,000.

10/15/09 Declared and paid a cash dividend of $2 per share.

11/15/09 Reissued 400 shares of treasury stock at $32 each. 12/15/09 Reissued the remaining treasury stock at $10 per share.

Iv. (10 points) The stockholders' equity section on the 12/31/08 balance sheet of Wheat Corporation was:

Stockholders' Equity

Contributed capital:

Common stock, $?? par value, authorized 30,000 shares; issued 20,000 shares; outstanding 9,000 shares ... $27,000

Preferred stock, par value $50, authorized 20,000 shares; issued and outstanding, 10,000 shares .... 500000

Contributed capital in excess Contributed capital in excess Contributed capital, treasury Retained Earnings Cost of treasury stock,

REQUIRED 1. What was the par value of the common stock?

2. What is the number of shares held as treasury stock?

3. If common stock was issued only once, what was the issue price per share?

4. How much did the treasury stock held cost per share?

5. How much is total stockholder' equity? of par, common of par, preferred stock transactions common 500,000 13,000 10,000 3,000 326,000 22,000

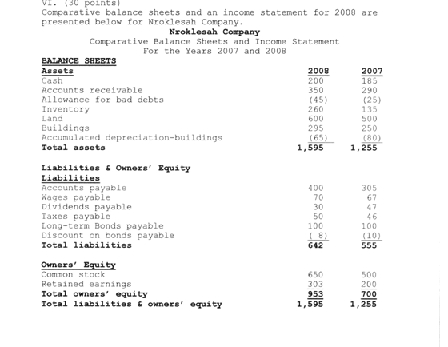

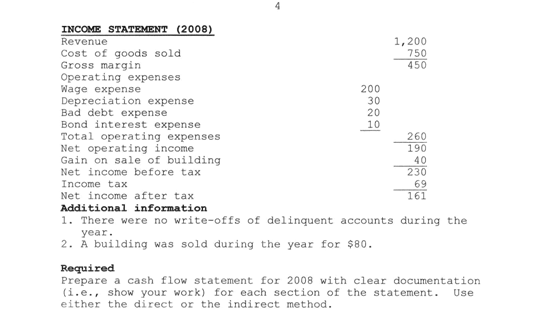

3 V.(10 points) Use the data from Problem VI. For the most recent year (2008) calculate the following ratios.

1. Current ratio 2. Inventory turnover 3. Rate of return on total assets 4. Accounts receivable turnover (assume all sales are on account) 5. Debt ratio.