Reference no: EM132594382

2103AFE Company Accounting - Griffith University

Question 1

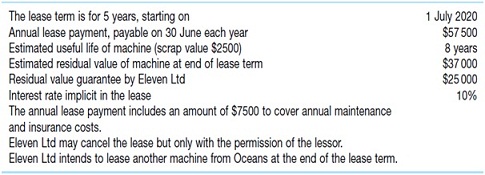

Oceans Ltd manufactures specialised moulding machinery for both sale and lease. On 1 July 2020, Oceans Ltd leased a machine to Eleven Ltd. The machine being leased cost Oceans Ltd $195 000 to make and its fair value at 1 July 2020 is considered to be $212 515. The terms of the lease are as follows.

Required:

1.Classify the lease for Oceans Ltd. Justify your answer.

2. Prepare

(a) the lease receipts schedule for Oceans Ltd (show all workings) and

(b) the journal entries in its books for the year ended 30 June 2021.

Question 2

Gran Ltd has entered into an agreement to lease a D9 bulldozer to Torino Ltd. The lease agreement details are as follows.

Length of lease 5 years

Commencement date 1 July 2019

Annual lease payment, payable 30 June each year commencing 30 June 2020 $8,000

Fair value of the bulldozer at 1 July 2019 $34 797

Estimated economic life of the bulldozer 8 years

Estimated residual value of the bulldozer at the end of its economic life $2 000

Residual value at the end of the lease term,of which

50% is guaranteed by Torino Ltd $7 200

Interest rate implicit in the lease 5%

The lease is cancellable, but a penalty equal to 50% of the total lease payment is payable on cancellation. Torino Ltd does not intend to buy the bulldozer at the end of the lease term. Gran Ltd. Incurred $ 1,000 to negotiate and execute the lease agreement. Gran Ltd. purchased the bulldozer for $34,797 just before the inception of the lease.

Required

1. Prepare a schedule of lease payment for Torino Ltd.

2. Prepare journal entries to record the lease transactions for the year ended 30 June 2020 in the record of Torino Ltd.

3. State how Gran Ltd should classify the lease. Give reasons for your answer.

Q3. Additional questions that will be provided in the workshop.

Appendix

Table - PV of $1

This table shows how much $1 in n=number of years time will be worth now, at the discounted (implicit) interest rate given

Table - PV of $1 Annuity

This table shows how much $1 EVERY YEAR for n=number of years will be worth now, at the discounted (implicit) interest rate given

|

What is the simple rate of return on the initial investment

: These cash flows from operations occur uniformly throughout the year. What is the simple rate of return on the initial investment

|

|

Find the expected net cash flow from the project

: The initial cost of the equipment for the project is $23,000, find the expected net cash flow from the project in the tenth year

|

|

Constantly change and adapt to remain agile

: In today's organizations that must constantly change and adapt to remain agile enough to keep up with the competition,

|

|

Compute the Depletion and Depreciation expense

: Mining equipment bought amounted to P850,000. Compute the Depletion and Depreciation expense for each of the first four years. Show computations in good form

|

|

2103AFE Company Accounting Assignment

: 2103AFE Company Accounting Assignment Help and Solution, Griffith University - Assessment Writing Service - Prepare the lease receipts schedule for Oceans

|

|

Find the annual cash savings after tax

: It is being depreciated at P8,000 per year. The income tax rate is 25%. Find the annual cash savings after tax

|

|

Strategic initiatives-long term strategy

: Strategic Initiatives - Long term strategy(s) for the company.

|

|

Human expression in areas of literature-culture and film

: Analyze the impact of human expression in the areas of literature, art, culture, music, or film.

|

|

Compute Garrison ending work-in-process inventory

: Actual manufacturing overhead by year-end totaled $280,000. Compute Garrison's ending work-in-process inventory

|