Problem: Warming Up

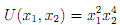

Luke likes to consumer CDs (good1) and pizzas (good 2). His preference over both goods is given by the utility function

If Luke allocates $200 to spend on both goods and if a case of CDs costs $20 and a pizza costs $10, how many cases of CDs and pizzas would he consume in order to maximize his utility subject to his income. Show your work and illustrate your answer graphically.

Problem

Consider Garoeldís utility function given as

U(x1; x2) = x1x2;

where x1 is lasagna and x2 is "everything else". Suppose his allowance from Jon is m = $8 and p1 = $1 and p2 = $1

(i) Find Garfieldís optimal choice of lasagna and everything else and illustrate your answer graphically. Show your work.

(ii) Find an expression of Garfieldís marginal rate of substitution between lasagna and all other goods and explain its meaning at the initial choice that you found in (i).

(iii) If the price of lasagna doubled, i.e., p1 increased from p1 = $1 to p 0 1 = $2, what would be Garfieldís new optimal bundle? Show the bundle on your graph.

(iv) Under the assumption that Garfieldís demand for lasagna is linear, derive the demand equation from his two optimal bundles computed in (i) and (iii). Illustrate your answer graphically by drawing two graphs: one representing Garphieldís optimal choice and theother representing his demand curve for lasagna driven from the two optimal bundles.

(v) Compute Garfieldís price elasticity of demand for lasagna between the two prices p1 = $1 and p0 1 = $2 and explain its meaning.

(vi) Compute Garfieldís price elasticity of demand at p1 = $3:

(vii) If Garfield always consumes lasagna with garlic bread. Show the e§ect of an increase in the price of wheat on (a) the wheat market, (b) the bread market, and (c) the market for lasagna. Draw three graphs to illustrate your answer (one graph for each market).