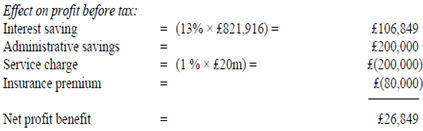

Q. Relative costs and benefits?

Option 1- Factoring

Reduction in receivables days = 15 days

Reduction in receivables =15/365* £20m

= £821916

Option 2 - The discount

With year-end receivables at £4.5m the receivables collection period was

£4.5m/£20m × 365 = 82 days

The scheme of discounts would change this as follows

10 days for 20% of customers

20 days for 30% of customers

82 days for 50% of customers

Average receivables days becomes

(20% * 10) + (30% * 20) + (50% * 82) = 49 days

The cost of the discount would be:

(3% * 20% * $20m) + (1.5% * 30% * £20m) = (£210000)

Consequently average receivables would reduce from the present $4.5rri to 49 × (£20m-£0.21m)/365 = £2656740

The interest saving would be 13% × £4.5m - £2.657m) = £239590

The net advantage to profit before tax would be

(£239590 - £210000) = £29590

The figures involve that submission settlement discounts is somewhat the more attractive but this result relies on the predicted proportions of customers in fact taking up the discount and paying on time. It as well abandons the possibility that some customers will insist on taking the discount without bringing forward their payments. Marton would have to consider a suitable response to this problem.

In contrast the assessment of the value of using the factor depends on the factor lowering Marton's receivables days. If the factor remains these benefits for itself rather than passing them on to Marton, this will elevate the cost of the factoring option. Additionally it isn't clear what benefit the insurance premium gives Marton.