Production

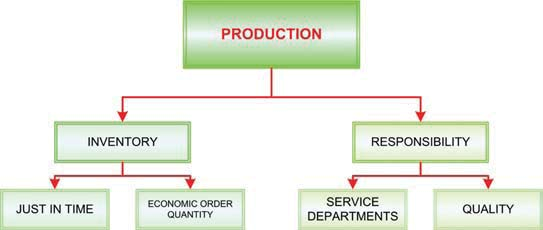

As you would suspect, effectively directing an organization needs prudent management of production. Because this is a hands-on process, and often entails dealing with the tangible portions of the business such as inventory, fabrication, assembly, etc., some managers are particularly focused on this area of oversight. Managerial accounting provides number of tools for managers to use in support of the production and production logistics which is moving goods through the production cycle to the customer. To simplify, production management is more about running a "lean" business model. This means that the costs must be minimized and efficiency should be maximized, while seeking to enhanced output and quality standards. In the last few decades, development in technology has greatly contributed to the ability to run the lean business. Product fabrication and assembly have been improved through almost error free robotics. Accountability is handled via comprehensive software that tracks the array of data on the real-time basis. These enterprise resource packages (ERP) are extensive in the power to deliver specific query-based information for even the biggest organizations. B2B (business to business) systems enable data interchange with the sufficient power to enable one company's information system to automatically begin a product order on a vendor's information system. Looking forward, much is being said about the potential of the RFID (radio frequency identification). Tiny micro processors are embedded in the inventory and release radio frequency signals that enable the computer to automatically track quantity and location of the inventory. M2M (machine to machine) enables the connected devices to communicate necessary information such as electric meters which no longer need to be read for billing, without needing human engagement. These developments are exciting, sometimes frightening, but these ultimately enhance organizational efficiency and the living standards of the customers who benefit from better and the cheaper products. But, in spite of their robust power, they do not replace human decision making. Managers should pay attention to the information being produced, and be prepared to adjust the business processes to respond. Production is a complex process needing constant decision making. It is almost impossible to totally categorize and cover all of the decisions that will be needed. But, number of organizations will share same production issues relating to inventory management and the responsibility assignment tasks.

Inventory -- For a manufacturing company, managing inventory is very important. Inventory may comprise of raw materials, work in process, and the finished goods. The unprocessed materials are the components and parts that are to be processed into the final product. Work in process comprises of goods under the production. Finished goods are the completed units awaiting sale to the customers. Each category will need special consideration and control over it. Failure to appropriately manage any category of inventory can be dangerous to a business. Overstocking raw materials and the overproduction of finished goods will increase the costs and obsolescence. On the other hand, out-of-stock situations for raw materials will quite the production line at the potentially great cost. Failure to have finished goods on hand may result in lost sales and customers/clients. Throughout following chapters, you will learn about methods/techniques and goals for managing the inventory. Some of these techniques carry popular acronyms such as JIT (just-in-time inventory management) and EOQ (economic order quantity). It is imperative for thaw good manager to understand the techniques/methods that are available to properly manage inventory.

Responsibility Considerations -- Enables and motivates employees to work at peak performance is an significant managerial role. For this to happen, employees should perceive that their productive efficiency and the quality of output are properly measured. A good manager will understand and be able to explain to others that how such measures are being determined. Your study of the managerial accounting will lead you through number of related measurement topics. For example, direct productive processes should be supported by number of "service departments" such as maintenance, engineering, accounting, cafeterias, etc. These service departments do not have anything to sell to the outsiders, but are very essential components of operation. The costs of service departments must be recovered for the business to survive. It is easy for a production manager to focus exclusively on the area under direct control, and ignore costs of support tasks. Yet, good management decisions need full consideration of the costs of support services. You will learn alternative techniques/methods that managerial accountants use to allocate the responsibility for organizational costs. A good manager understands the need for such allocations, and be capable to explain and justify them to employees who may not be totally cognizant of why profitability is more difficult to achieve than it may seem.

Additionally, techniques/methods must be utilized to capture cost of quality -- or perhaps better said, cost of the lack of quality. Finished/processed goods which do not function as promised entail substantial warranty costs, shipping (back and forth!) including rework, and the scrap. There is also an extreme long-run cost linked with a lack of the customer satisfaction.

Understanding fundamentals of responsibility accounting will also need you to think about attaching inputs and the outcomes to those responsible for their final disposition. In other words, the manager should be held accountable, but to do this needs the ability to monitor costs incurred and deliverables created by circumscribed areas of accountability are the centres of responsibility. This does not occur by accident and needs extensive systems development work, as well as the training and explanation, on the part of management and accountants.