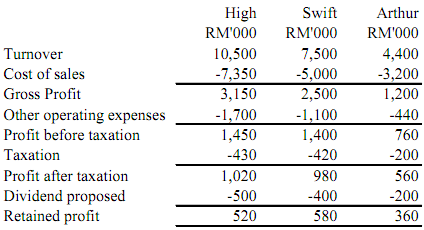

High Bhd acquired shares in two other companies as follows:

Additional information:

i) Goodwill on acquisition of Swift was impaired by RM80,000 as at 31 October 2009 and is to be written off as an expense.

ii) On 1 October 2009 Swift sold goods to High at a margin of 20%. These goods had a sales value of RM200,000. As at 31 October 2009, High still held RM140,000 of these goods in stocks.

iii) High has not yet accounted for any dividends receivable from Swift or Arthur. The dividends from Arthur all relate to the post-acquisition period.

iv) High requires Arthur to bring its depreciation methods in line with the group accounting policies. The directors have estimated that this would reduce the profit of Arthur for the year ended 31 October 2009 by RM100,000. Ignore any effect on the taxation charge.

v) The retained profit brought forward at 1 November 2008 for the three companies was:

Required:

a) Calculate the goodwill on acquisition of Swift and Arthur.

b) Prepare the Consolidated income statement of the group for the year ended 31 October 2009.

c) Prepare the consolidated statement of reserves of the group for the year ended 31 October 2009.