The amount by which the market price exceeds the conversion value or the investment value called the premium. When expressed as a percentage, it is given by,

Conversion premium = (Market Price - Conversion value)/Conversion value x 100

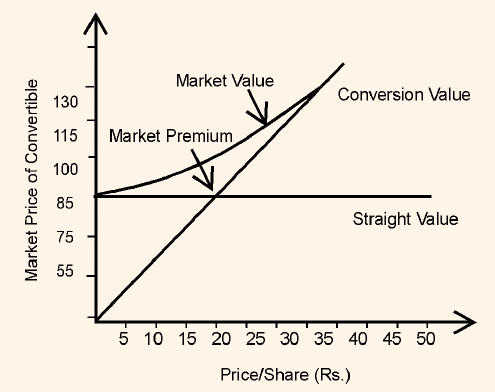

The conversion value can be lower than or greater than the investment value. Irrespective of this, the premium exists. This may be due to the investor's expectations that in future, the underlying stock may experience a price rise. These relationships can be better understood from Figure 1.

Figure 1

From Figure 1, we observe that the investment value serves as a floor for the price of the convertible security, in a scenario of price decline of the underlying stock. When the market price of the stock exceeds certain value, the conversion value exceeds the investment value. The market value of the convertible security on most occasions exceeds its conversion value and investment value. The market premium is greatest at the point of intersection of the investment value and the conversion value.

In the above figure, we could understand the changes in the market price of the convertible with respect to conversion and investment values figuratively. If we express these relationships in relative terms, we have the following ratios:

Premium over Conversion Value =

Premium over Investment Value =