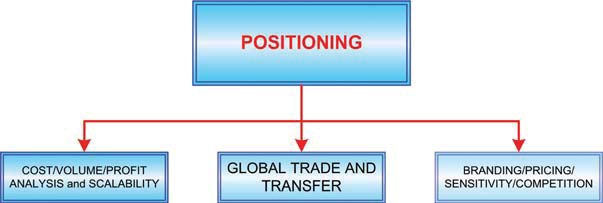

Positioning

An essential part of the planning process is positioning the organization to attain its goals. Positioning is a wide concept and depends on gathering and evaluating the accounting information.

Cost/profit/Volume Analysis and the Scalability -- In a subsequent chapter, you will get to know about cost/profit/ volume (CVP) analysis. It is very important for managers to understand the nature of the cost behaviour and how changes in volume impact profitability. You will get to know about calculating break- even points and how can you manage to achieve target income levels. You will start to think about business models and the ability (or inability) to bring them to profitability via rise in scale.

Managers call ahead their internal accounting staff to pull together information and make the appropriate required recommendations.

Global Trade and Transfer -- The management accountant often performs significant and complex analysis related to the global business activities. This needs in-depth research into laws about tariffs, shipping and taxes. In addition, global enterprises can transfer inventory and services between affiliated units in alternative countries. These transactions should be fairly and correctly measured to establish reasonable transfer prices and potentially run afoul of tax and other rules of the various countries involved. Once again, management accountant is known to the task.

Branding/Sensitivity/Pricing Competition - In positioning the company's products and services, considerable thought should be given to branding and its impact on the business. To build a brand needs considerable investment with the uncertain payback. Often, the same product can be "positioned" as the elite brand via a huge investment in up-front advertising, or as a common consumer product that will depend upon low price to drive sales. What is the proper approach? Information is required to make the decision, and management will probable enlist the internal accounting staff to make prospective information based upon alternative scenarios. Likewise, product pricing decisions should be balanced against costs and competitive conditions of market. And, sensitivity analysis is required to determine how sales and costs will respond to the changes in market conditions.

As you can observe decisions about positioning a company's products and services are kind of very complex. The prudent manager will require considerable data to make reliable and good decisions. Management accountants will be directly concerned in providing such data. They will typically work side-by-side with management in helping them correctly interpret and utilize information. It behoves a very good manager to study the basic principles of managerial accounting in order to understand better how information can be effectively utilized in the decision process. With these sorts of topics in play, it is no surprise that the term "strategic finance" is increasingly used to characterize this particular profession.