Question 1

(a) These are merely the differences of the two prices. Consequently the mark to market losses are given by {Q1 - Q0,Q2 - Q0,Q3 - Q0,Q4 - Q0,Q5 - Q0}.

Certainly negative losses are gains.

(b) You just compute the interest accrued after multiplying by 1/360 for every day and

(c) Subsequently adding the gains and losses.

Question 2

(a) Treasurer has threats for three months starting in three months. Consequently a 3×6 FRA is needed.

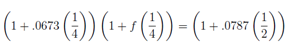

(b) To obtain the break even rate we need:

(c) Lowest obtainable rate. (6.87%)

(d) (FRA settlement) (.0687 -.0609) (38 million)(1/4)

Question 3

(a) The futures price has moved by 34 ticks. (It moved from Qt0 = $94.90 to Qt1 = $94.56.

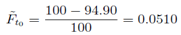

(b) The current implicit forward rate is given by

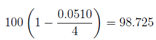

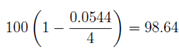

Which signifies the buyer of the contract needs to deposit

Dollars per $100 dollars on expiry that is in three months in this case

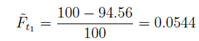

(c) In three months the futures price shifts to Qt1 = $94.56 giving a implied forward rate of

Also a settlement of

Therefore the buyer of the original contract receives compensation as if she were making a deposit of $98.725 also receiving a loan of $98.64 making a loss of

98.64 - 98.725 = -0.085 per $100 dollars ⇒ Loss of $595000

Since the total involved is $7 million.

Question 4

(a) The trader will purchase (sell) the Libor-based FRA also sell (buy) Tibor based FRA. This approach the market risk inherent in the Libor positions will be eliminated to a large degree. Nevertheless Tibor and Libor fixings occur at different times consequently there still some risk in this position.

(b) Utilize two cash flow diagrams one for Libor FRA the other for the Tibor FRA. In one case the trader is paying fixed in addition to receiving floating. The other cash flow figure will display the reserve situation. In this situation the two fixed rates are known and their difference will remain fixed. The trader will have experience to the difference between the floating rates.

(c) If Libor panel is made of better-rated banks after that the Libor fixings will be lower everything else being the same. This signifies that the spread between Libor and Tibor will widen. According to this traders require to buy the spread if they decide to take such a speculative position.