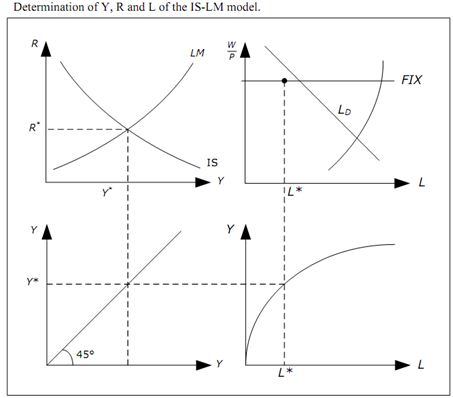

Q. Explain the problem with IS-LM model?

The starting point of AS-AD model is an assumption in IS-LM model (and in the cross model) that limits its usefulness. This is an assumption that if firms where to choose profit maximizing quantity of L (LOPT), they would produce more than aggregate demand. In IS-LM, YOPT> YD should hold.

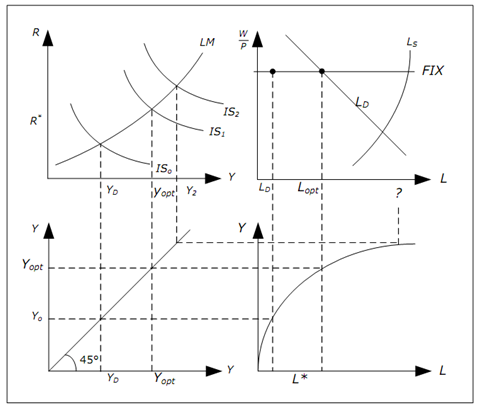

To realize why it is a problem in IS-LM model, we gradually increase aggregate demand by increasing G. We can explain the process using figure below.

Figure: Illustrating the problem in the IS-LM model

1. Let's begin with a given real wage W/P, an IS curve (IS0) and an LM curve. In equilibrium, we would have Y = Y0 and L = L0.

2. Now increase G so that IS curve shifts outwards from IS0 to IS1. In the first step, we increase G just enough so that Y = YOPT in equilibrium It implies exactly to the level that firms want to produce at the given real wage.

3. Firms would now want to hire LOPTthat is precisely the profit-maximizing quantity of L. It is no longer essential for firms to hire less than profit maximizing quantity as there is no longer a shortage in aggregate demand. Thus far, no problems in IS-LM model.

4. Now imagine that we increase G even more so that IS curve shifts to IS2 such that Y = Y2> YOPT. Now IS-LM model is in trouble.

5. According to production function, to produce Y = Y2 we need L = L2. However firms will only hire LOPT if real wage is constant (that is presumed in IS-LM model). LOPT is the profit maximizing quantity - to produce more would decrease profits.

6. As firms won't hire more than LOPT if real wages are constant, GDP can't be larger than of YOPT in the IS-LM model. This model simply can't give an answer to what will happen when we increase G in step 4 as we would be violating one of the main assumptions of IS-LM model.

This problem isn't limited to changes in G and shifts in IS-curve. The same problem appears when we change MS and shift LM-curve. If we shift LM-curve to the right by an amount such that Y > YOPT, the IS-LM model can't be used.

IS-LM model isn't 'wrong', but it's applicable only as long as Y > YOPT. Normally the IS-LM model will perform reasonable as long as price level is stable (low inflation) and it will do better in a recession than in a boom.